Reference no: EM131332704

Repeat given Exercise, where S includes 20 states of nature, the true state of nature is s13, and the beliefs of the players are given in the following table:

Exercise 10.37

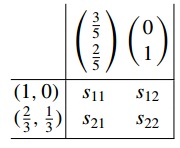

In this exercise, suppose there are four states of nature, S = {s11, s12, s21, s22}. The information that Player I receives is the first coordinate of the state of nature chosen, while the information that Player II receives is the second coordinate. The conditional probabilities of the players, given their respective informations, are given by the following table (the conditional probability of Player I appears in the left column, while the conditional probability of Player II appears in the top row of the table):

The table is to be read as stating, e.g., that if Player I receives information indicating that the state of nature is contained in {s11, s12}, he believes with probability 1 that the state of nature is s11.

(a) Construct a belief space in which the described situation is represented by a state of the world and indicate that state. Suppose that the state of nature is s12, and that ω is the corresponding state of the world. Answer the following questions:

(b) What are the minimal belief subspaces Y˜I(ω) and Y˜II(ω) of the players?

(c) Is Y˜I(ω) = Y˜II(ω)?

(d) Is there a common prior p over S such that the players agree that the state of the world has been chosen according to p?

(e) Is the state of the world ω ascribed positive probability by p?

|

What would risk-free rate have to be for two stocks

: Stock Y has a beta of 1.45 and an expected return of 13.50 percent. Stock Z has a beta of .70 and an expected return of 10.00 percent. What would the risk-free rate have to be for the two stocks to be correctly priced relative to each other?

|

|

What was the last dividend

: S. Ramos Company’s stock has a required rate of return of 11.50%, and it sells for $25.00 per share. Goode's dividend is expected to grow at a constant rate of 7.00%. What was the last dividend, D0? show work.

|

|

What is bonds nominal yield to call

: Vidal Corporation has a bond outstanding with 15 years to maturity, an 8.25% nominal coupon, semiannual payments, and a $1,000 par value. The bond has a 6.50% nominal yield to maturity, but it can be called in 6 years at a price of $1,120. What is th..

|

|

What is the firms cost of internal common equity

: The common stock for the Bestsold Corporation sells for $59. If a new issue is sold, the flotation costs are estimated to be 8 percent. The company pays 70 percent of its earnings in dividends, and a $6.30 dividend was recently paid. What is the firm..

|

|

Construct a belief space in the described situation

: Construct a belief space in which the described situation is represented by a state of the world and indicate that state.

|

|

Prepare return as if you were preparing it for actual client

: Prepare the return as if you were preparing it for an actual client. All necessary forms and schedules should be attached to the return, and properly and neatly completed.

|

|

Rate of return for the global pepe investment fund

: Consider the following information and then calculate the required rate of return for the Global Pepe Investment Fund (GPIF), which holds 4 stocks. The market’s required rate of return is 13.25%, the risk-free rate is 7.00%, and the Fund’s assets are..

|

|

Confidence interval estimate of the mean birth weight

: What is the confidence interval estimate of the mean birth weight for all such babies? __g to __g (Round to the nearest integer as needed.)

|

|

Confidence interval estimate of the mean birth weight

: What is the confidence interval estimate of the mean birth weight for all such babies? __g to __g (Round to the nearest integer as needed.)

|