Reference no: EM132065059

Assignment

Your company Portfolio Manager is convening a review board in the first calendar quarter to consider three mutually exclusive projects. You have been asked to provide recommendations with respect to the capital budgeting aspects of these projects.

Your recommendations will be considered by the review board along with other non-financial aspects of the projects. Initial (year 0) funding will be provided in the current year for the single project selected.

Note: The review board may select a project for strategic reasons even if the financial aspects are not ideal.

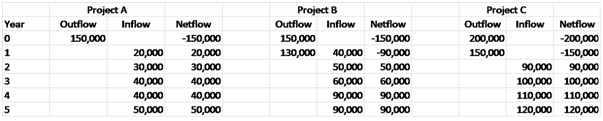

Project sponsors have provided the following estimated cash flow projections:

The company has not yet decided how the selected project will be financed. The cost of capital or hurdle rate will vary depending upon how the company decides to finance the project. You decide to compare projects in three areas: (1) payback period (not considering the cost of capital); NPV sensitivity (see note 1 below); and (3) Internal Rate of Return (IRR). Conduct each analysis and interpret the results.

You must make as complete a recommendation as possible so that the board understands the financial implications of whatever decision they make. Based on your analysis, what would you recommend to the review board and why? Your recommendation must be based on the combination of all three factors (payback period, IRR, and NPV sensitivity).

Show all calculations supporting your recommendation. Calculate NPV to the nearest dollar, IRR to three decimal places, and payback period to one decimal place.

Note 1: Project NPV varies inversely with the cost of funds to perform the project (expressed as the hurdle rate or k in the NPV discount factor formula). Some project NPVs are more sensitive to changes in k than others. See the NPV Profile discussion in Gallagher, Chapter 10, pages 278-279 (Reserved Readings) for information on determining NPV sensitivity.

|

How many times nursing residents fell in the last

: A recent visit to a nursing home showed how many times nursing residents fell in the last 24 months. The data is 0,0,1,2,3,6,1,2,4,1,3,4,11,10,8,8,0,0,0,1.

|

|

Statements correctly defines the null hypothesis

: (i) Which of the following statements correctly defines the null hypothesis HO?

|

|

Confidence interval for the mean amount of time

: How would I determine and interpret a 99?% confidence interval for the mean amount of time Americans age 15 or older spend eating and drinking each day.

|

|

Proportion of adults who have? high-speed internet

: How do I solve the follow problem? Lets say that If a researcher wishes to estimate the proportion of adults who have? high-speed Internet access.

|

|

Conduct each analysis and interpret the results

: Your company Portfolio Manager is convening a review board in the first calendar quarter to consider three mutually exclusive projects.

|

|

Effect of nutritional supplements on strenght training

: An exercise physiologist studies the effect of nutritional supplements on strenght training. They measured strength in athletes prior to taking a regimen

|

|

Cramer-rao lower bound

: Set ??=1/?? . Does the MLE of ??? attains the Cramer-Rao lower bound?

|

|

What is descriptive statistics

: Problem: What is descriptive statistics and what is pearson correlation statistic procedures?

|

|

Conduct disorder with a callous-unemotional

: Research Scenario: Twenty-four male adolescents who have been diagnosed with conduct disorder with a callous-unemotional presentation

|