Reference no: EM131117010

- 31.Computing Product Costs Using Activity-Based Costing. Stillwater Company identified the following activities, estimated costs for each activity, and identified cost drivers for each activity for this coming year. (These are the first three steps of activity-based costing.)

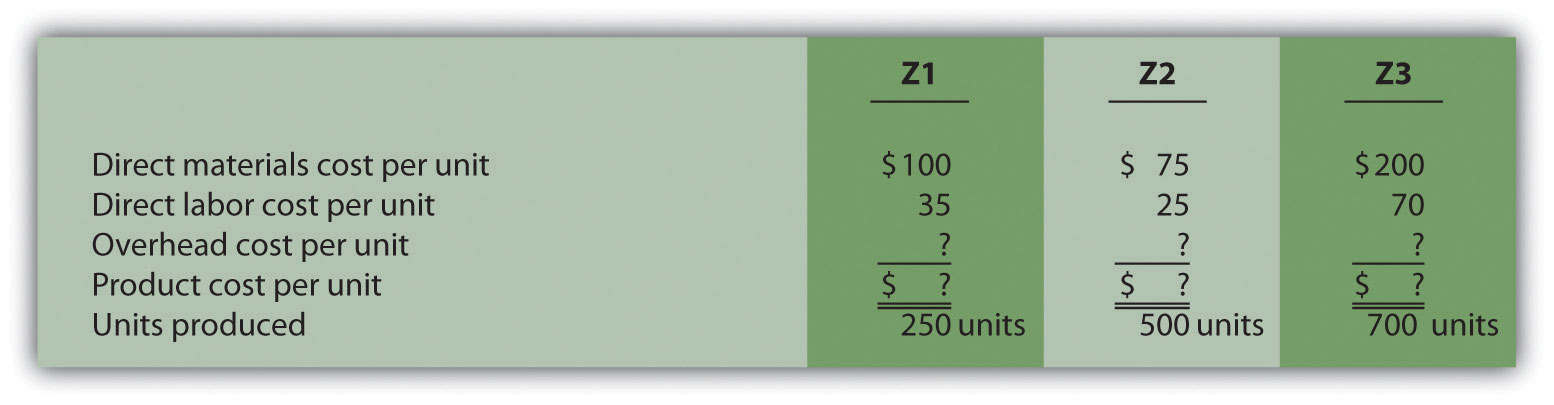

- The company produces three products, Z1, Z2, and Z3. Information about these products for the month of January follows:

- Actual cost driver activity levels for the month of January are as follows:

-

Required:

- Using the estimates for the year, compute the predetermined overhead rate for each activity (this is step 4 of the activity-based costing process).

- Using the activity rates calculated in requirement a and the actual cost driver activity levels shown for January, allocate overhead to the three products for the month of January (this is step 5 of the activity-based costing process).

- For each product, calculate the overhead cost per unit for the month of January. Round results to the nearest cent.

- For each product, calculate the product cost per unit for the month of January. Round results to the nearest cent.

32.Journal Entry to Apply Overhead. Caspian Company is deciding which of three approaches it should use to apply overhead to products. Information for each approach is provided in the following.

- Direct labor costs for the year totaled $80,000. Using the plantwide method, calculate the amount of overhead applied to products and make the appropriate journal entry.

- During the year, the Machining department used 1,000 machine hours, and the Assembly department used 1,200 direct labor hours. Using the department method, calculate the amount of overhead applied to products and make the appropriate journal entry.

- During the year, 900 purchase requisitions were processed, 1,300 production setups were performed, and 400 products were inspected. Using the activity-based costing approach, calculate the amount of overhead applied to products, and make the appropriate journal entry.

-

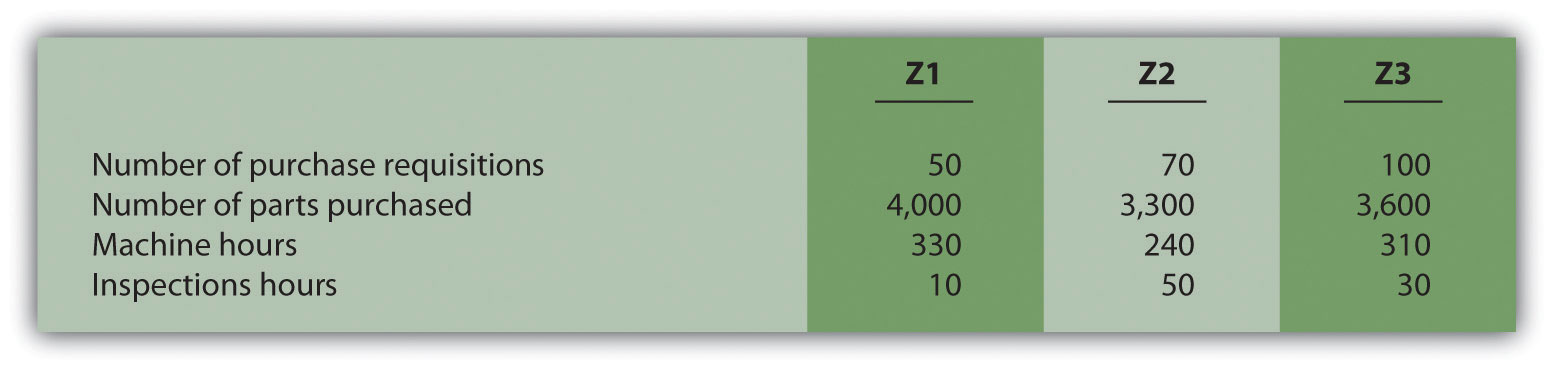

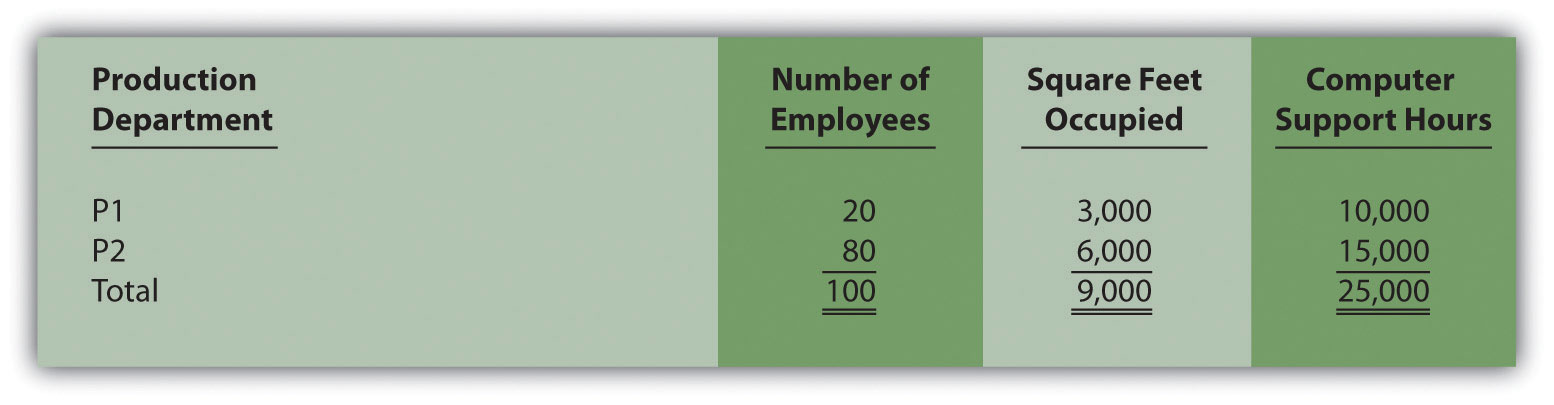

Allocating Service Department Costs. Crandall Company has two production departments (P1 and P2) and three service departments (S1, S2, and S3). Service department costs are allocated to production departments using the direct method. The $400,000 costs of department S1 are allocated based on the number of employees in each production department. The $600,000 costs of department S2 are allocated based on the square footage of space occupied by each production department. The $300,000 costs of department S3 are allocated based on hours of computer support used by each production department. Information for each production department follows.

Required:

- Calculate the service department costs allocated to each production department.

- In general, do U.S. Generally Accepted Accounting Principles allow for the allocation of service department costs to production departments for the purpose of valuing inventory?

22.Calculating Equivalent Units. Complete the requirements for each item in the following.

- A university has 500 students enrolled in classes. Each student attends school on a part-time basis. On average, each student takes three-quarters of a full load of classes. Calculate the number of full-time equivalent students (i.e., calculate the number of equivalent units).

- A total of 10,000 units of product remain in the Assembly department at the end of the year. Direct materials are 80 percent complete and direct labor is 40 percent complete. Calculate the equivalent units in the Assembly department for direct materials and direct labor.

- A local hospital has 60 nurses working on a part-time basis. On average, each nurse works two-thirds of a full load. Calculate the number of full-time equivalent nurses (i.e., calculate the number of equivalent units).

- A total of 6,000 units of product remain in the Quality Testing department at the end of the year. Direct materials are 75 percent complete and direct labor is 20 percent complete. Calculate the equivalent units in the Quality Testing department for direct materials and direct labor.

25.Assigning Costs to Products: Weighted Average Method. Sydney, Inc., uses the weighted average method for its process costing system. The Assembly department at Sydney, Inc., began April with 6,000 units in work-in-process inventory, all of which were completed and transferred out during April. An additional 8,000 units were started during the month, 3,000 of which were completed and transferred out during April. A total of 5,000 units remained in work-in-process inventory at the end of April and were at varying levels of completion, as shown in the following.

| Direct materials |

40 percent complete |

| Direct labor |

30 percent complete |

| Overhead |

50 percent complete |

The following cost information is for the Assembly department at Sydney, Inc., for the month of April.

|

Direct Materials |

Direct Labor |

Overhead |

Total |

| Beginning WIP inventory |

$300,000 |

$350,000 |

$250,000 |

$900,000 |

| Incurred during the month |

$180,000 |

$200,000 |

$170,000 |

$550,000 |

Required:

- Determine the units to be accounted for and units accounted for; then calculate the equivalent units for direct materials, direct labor, and overhead. (Hint: This requires performing step 1 of the four-step process.)

- Calculate the cost per equivalent unit for direct materials, direct labor, and overhead. (Hint: This requires performing step 2 and step 3 of the four-step process.)

- Assign costs to units transferred out and to units in ending WIP inventory. (Hint: This requires performing step 4 of the four-step process.)

- Confirm that total costs to be accounted for (from step 2) equals total costs accounted for (from step 4). Note that minor differences may occur due to rounding the cost per equivalent unit in step 3.

- Explain the meaning of equivalent units.

20.Identifying Cost Behavior. Vasquez Incorporated is trying to identify the cost behavior of the three costs that follow. Cost information is provided for three months.

|

| Cost A | Cost B | Cost C |

| Month |

Units Produced |

Total Costs |

Cost per Unit |

Total Costs |

Cost per Unit |

Total Costs |

Cost per Unit |

| 1 |

1,500 |

$1,500 |

_____ |

$4,500 |

_____ |

$3,000 |

_____ |

| 2 |

3,000 |

1,500 |

_____ |

5,250 |

_____ |

6,000 |

_____ |

| 3 |

750 |

1,500 |

_____ |

3,750 |

_____ |

1,500 |

_____ |

Required:

- Calculate the cost per unit, and then identify how the cost behaves for each of the three costs (fixed, variable, or mixed). Explain the reasoning for your answers.

- How does identifying cost behavior patterns help managers?

21.Account Analysis. Cordova Company would like to estimate production costs on an annual basis. Costs incurred for direct materials and direct labor are variable costs. The accounting records indicate that the following production costs were incurred last year for 50,000 units.

| Direct materials |

$100,000 |

| Direct labor |

$215,000 |

| Manufacturing overhead |

$300,000 (20 percent fixed; 80 percent variable) |

Required:

Use account analysis to estimate the fixed costs per year, and the variable cost per unit.

22.High-Low Method. The city of Rockville reported the following annual cost data for maintenance work performed on its fleet of trucks.

| Reporting Period (Year) |

Total Costs |

Level of Activity (Miles Driven) |

| Year 1 |

$ 750,000 |

225,000 |

| Year 2 |

850,000 |

240,000 |

| Year 3 |

1,100,000 |

430,000 |

| Year 4 |

1,150,000 |

454,000 |

| Year 5 |

1,250,000 |

560,000 |

| Year 6 |

1,550,000 |

710,000 |

Required:

- Use the four steps of the high-low method to estimate total fixed costs per year and the variable cost per mile. State your results in the cost equation form Y = f + vX.

- What would the estimated costs be if the trucks drove 500,000 miles in year 7?

|

Grissom company estimates that variable costs

: Grissom Company estimates that variable costs will be 60% of sales, and fixed costs will total$800,000.The selling price of the product is $4.Instructions(a) Prepare a CVP graph, assuming maximum sales of $3,200,000.

|

|

Modify it to operate like the d flip-flop

: Modify it to operate like the D flip-flop of Figure P6.1.48 (b).

|

|

Identify three corporate brand components

: Select a major business enterprise and identify three corporate brand components (i.e name, slogan etc.) and how effective each is in building brand equity for the company. Leonardo's cupcake factory has fixed cost of $7000 per month. Donuts sell for..

|

|

Fields for populating the customer table

: 1. Create an HTML page containing fields for populating the customer table with the description shown below. Write a JSP page to read the data from the HTML page and post it in the database and send display a thank you message.

|

|

Computing product costs using activity-based costing

: 31.Computing Product Costs Using Activity-Based Costing. Stillwater Company identified the following activities, estimated costs for each activity, and identified cost drivers for each activity for this coming year. (These are the first three step..

|

|

Explain how to determine the present value

: Consider the value of Wal-Mart as being composed of two parts, a U.S. part (due to business in the United States) and a non-U.S. part (due to business in other countries). Explain how to determine the present value (in dollars) of the non-U.S. part ..

|

|

Define appropriate CTMC for population of such organisms

: Suppose that a one-celled organism can be in one of two states – either A or B. An individual in state A will change to state B at an exponential rate alpha; an individual in state B divides into two new individuals of type A at an exponential rate b..

|

|

Understanding of encapsulation by creating accessor

: MyClone accessors and mutators: You will demonstrate your understanding of encapsulation by creating accessor and mutator methods for all instance variables of the MyClone class.

|

|

Discuss pros and cons of offering such benefits

: Summarize the benefits that each company provides to part-time employees. Discuss the pros and cons of offering such benefits to part-time employees. If you were responsible for making the decision of whether or not to provide benefits to part-tim..

|