Reference no: EM131791770

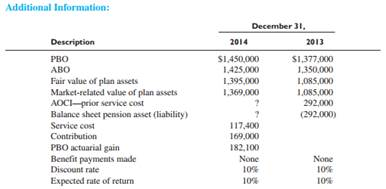

Question: Turner Inc. provides a defined benefit pension plan to its employees. The company has 150 employees. The average remaining service life of employees is 10 years. The AOCI-net actuarial (gain) loss was zero at December 31, 2013. Turner uses a market-related (smoothed) value to compute expected return.

Required: Round all amounts to the nearest dollar:

1. Compute the amount of prior service cost that would be amortized as a component of pension expense for 2014 and 2015.

2. Compute the actual return on plan assets for 2014.

3. Compute the unexpected net gain or loss on plan assets for 2014.

4. Compute pension expense for 2014.

5. Prepare the company's required pension journal entries for 2014.

6. Compute the 2014 increase/decrease in AOCI-net actuarial (gain) loss and the amount to be amortized in 2014 and 2015.

7. Confirm that the pension asset (liability) on the balance sheet equals the funded status as of December 31, 2014.