Reference no: EM13694629

Question 1: Compare the interest rate risk of a noncallable 10-year "treasury coupon bearing bond with a mortgage-backed pass-through security with prepayments related to the level of Interest rates -lower market interest rates raise the rate of prepayments.

Discuss how the changes in cash flows, arising from prepayments, on a mortgage-backed security affect the duration of such securities.

HINT: consider the coupon effect on duration.

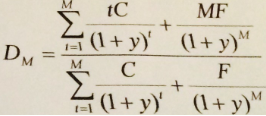

Macaulay Duration Measure:

Dm = ∂P/∂y (1 + y)/P For a coupon - bearing bond :

A more complete approximation to the proportional change in price of a bond with respect to a change in yield to maturity takes into account the convexity of the price-yield relationship for the bond:

dP/P = ∂P/∂y 1/P dy + 1/2 ∂2P/∂y2 1/P dy2

where P = Price, C = coupon, F = Face value, y = Yield to maturity, M = maturity (years), t = time (year), dP is the total change in price, and ∂P/∂y is the partial change in price with respect to a change in yiehito maturity.

The second term, excluding the dy2, is the convexity effect.

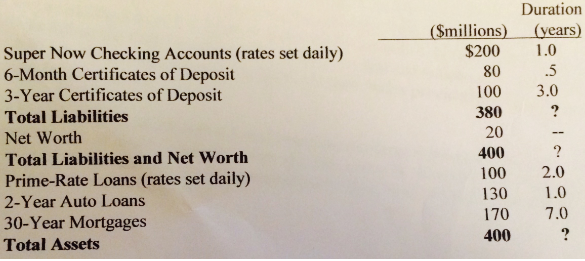

Quesiton 2: Consider the following bank balance sheet (fixed rates and pure discount securities unless indicated otherwise). Interest rates on liabilities (yuare 4 percent and on assets (yA) are 6 percent.

a. What is the duration of assets and the duration of liabilities?

b. The bank will (benefit)/(be hurt) if all interest rates rise. Define your terms and state clearly your assumptions.

ΔE = -Δy [DA(1+yA) - L/A DL/(1 + YL) ]A

Setting ΔE equal zero implies:

DA/1 + YA = L/A DL/(1 + yL)

ΔE = change in the market value of equity.

DA = duration of assets

DL = duration of liabilities.

L = market value of liabilities.

A = market value of assets, and

Δy = change in interest rates.

c. What is the duration of assets that would be necessary to immunize the market value of equity from interest rate changes for this bank's portfolio holding the D1 constant?

Question 3: Data on weekly stock prices for Microsoft Corporation, Exxon Mobil Corporation and the S&P 500 Index were used to compute the following historical volatility and expected return. Using these results, answer the following questions:

The historical returns volatility (standard deviation of returns) at an annualized rate for each stock are: MSFT= 0.182, XOM= 0.120 and S&P500 = 0.108. The expected return for each stock and the index at an annual rate for MSFT, XOM and S&P500 is respectively:

0.136 0.308 0.105

a. Using the computed β (beta) of 0.997 for MSFT and 0.508 for XOM and expected return for each stock and the S&P 500 index over the past year, draw the Securities Market Line (SML) using a risk-free rate of 5.37 percent based on the 3-month Libor rate at the time.

Do each of the stocks fall on the SML? Analyze their relative position and which stock is the best buy and why.

HINT: Use the average return of the S&P 500 stock index provided above as the expected return for the market.

b. Using the data in above and in a. and assuming the average return on the S&P 500 index is a representation of market expected return and risk, compute the slope of the Capital Market Line (CML) when the risk-free rate is approximated by the Libor rate given in a. From your results, what is the market price of risk?

|

Discount rate and the federal funds rate

: What is the difference between the Federal Reserve’s “discount rate” and the “federal funds” rate? Why is the discount rate in the US not as important in financial markets as the federal funds rate?

|

|

Prepare amortization tables for issuance of the bonds

: Prepare amortization tables for issuance of the bonds sold at 102 for the first three interest payments and show the long-term liabilities balance sheet presentation for issuance

|

|

In what sense does the fed create money

: In what sense does the Fed "create money"? Suppose that the minimum required reserve ratio for banks was 1/11. Also suppose that banks held no excess reserves and that currency in circulation was unchanged. What action in the Treasury bill market wou..

|

|

Political system of representative democracy

: “The Federal Reserve System is structured in such a way as to insulate monetary policy from the political pressures characteristic of the rest of our political system of representative democracy.” Do you agree or disagree with this quote? Explain you..

|

|

Compute the slope of the capital market line

: What is the duration of assets that would be necessary to immunize the market value of equity from interest rate changes for this bank's portfolio holding the D1 constant and compute the slope of the Capital Market Line (CML) when the risk-free ra..

|

|

The price of oranges has risen dramatically

: The price of oranges has risen dramatically. Which of the following is likely to happen?

|

|

Arguments for and or against protectionist trade barriers

: Recently the US has accused China of "dumping" solar panels on the US market. Research this and other "dumping" accusations either by the US, or against the US, and other countries. Choose one case. Explain the case to your classmates, take a positio..

|

|

Determine equilibrium price and output level in the market

: Consider a Bertrand oligopoly consisting of four firms that produce an identical product at a marginal cost of $260. The market demand for this product is P=800-4Q. Determine the equilibrium level of output in the market.

|

|

Consider four different oligopoly settings listed

: Consider four different oligopoly settings listed in this chapter, what are the main features for each of them, you need to prepare your answers from the following perspectives, the nature of products, the response of other firms, and the timing of d..

|