Reference no: EM131300953

Assignment -

1. The authors say, "The advent of the euro, the common European currency, altered the risk-return characteristics of the affected markets." How were optimal portfolios affected by the creation of the euro? Explain.

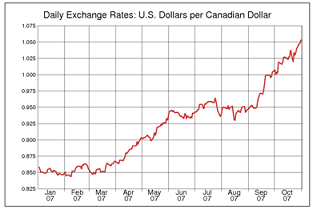

2. The following are quotes from an article that appeared on October 25, 2007 in the Financial Post (a Canadian financial newspaper). The article was entitled "It's too late to hedge against a rising loonie." [The "loonie" means the Canadian dollar.] At the time this article was written, the Canadian dollar was worth over US$1 (see graph below for Jan. 1-Nov. 1, 2007).

Briefly explain each quote below using course concepts. [Hint: Think about concepts such as exposure, over/under-valuation, market efficiency, benefits of portfolio diversification, etc.]

A) "The biggest losers [from the rising loonie] have been Canadians with U.S. stocks or equity funds, says financial author Gordon Pape. He doesn't blame those burned for second-guessing the time-honoured wisdom that global diversification is a good idea."

B) "Most of Canada's fund companies [i.e., mutual funds or other stock funds] do not hedge, because of the costs of doing so and the belief that over the long run, currency effects cancel out."

C) "Wilfred Hahn, chief investment officer at Hahn Investment Stewards, thought the loonie 'wildly overvalued' at US$0.92, let alone beyond parity [the current rate of approximately US$ = C$1]. He views the current level as a 'tragedy' and insists 'at some point it must come down.'"

3. You have the following information regarding the monthly returns on stock investments in the U.K. and the U.S.(measured in dollars):

Expected return Standard deviation Correlation matrix:

U.K. U.S.

U.K. 1.23 5.55 U.K. 1

U.S. 1.26 4.43 U.S. .58 1

Round all answers to two decimal places.

A) Compute the return on a portfolio with 25% U.S. assets and 75% British assets.

B) Compute the portfolio standard deviation for the portfolio in (A).

C) Compute the optimal weights for a portfolio of these two assets, assuming that the riskfree rate is 0.5 (percent per month).

U.S. weight: ________

U.K. weight: ________

D) Suppose that the correlation between U.S. and U.K. returns rises to 0.75. Compute the new optimal portfolio weights and explain why they change.

4. What would be the costs and benefits of having different currencies for each US state, with the exchange rates between these currencies being flexible? [Hint: Apply the theory of optimum currency areas.]

5. This question is about the same currency that you analyzed in the pre-assignment.

A) Present a graph of the value of that currency versus the US dollar over the last 15 months (the one year of the original assignment plus the period of fall quarter).

B) In one paragraph, explain the factors that have most affected the currency's value during this quarter.

C) Looking at your analysis here compared to your analysis in the pre-assignment, describe how your understanding of exchange rates changed as a result of taking this course.

|

What are pros and cons and risks associated withnikes

: What are the pros, cons, and risks associated withNike's core marketing strategy?- If you were Adidas, how would you compete with Nike?

|

|

Cost controls in health care reimbursement models

: Search the Internet for two articles about the methods of cost controls in health care reimbursement models and how the methods have affected the availability of services. Using the articles as resources, write at least two pages, addressing the ..

|

|

Terms of how much of a growing crop to hedge

: When production yield is uncertain, what does this suggest in terms of how much of a growing crop to hedge? Is this issue relevant for a storage hedge? Is this issue relevant for a livestock hedge? Explain why.

|

|

Maintain a constant four percent growth rate in dividends

: Gamma Corp. is expected to pay the following dividends over the next four years: $7.50, $8.25, $15, and $1.80. Afterward, the company pledges to maintain a constant 4 percent growth rate in dividends, forever. If the required return is 14 percent, wh..

|

|

Compute the return on a portfolio

: You have the following information regarding the monthly returns on stock investments in the U.K. and the U.S. Compute the return on a portfolio with 25% U.S. assets and 75% British assets. Compute the portfolio standard deviation for the portfolio i..

|

|

What is the yield to maturity

: New Markets has $1,000 face value bonds outstanding that pay interest semiannually, mature in 14.5 years, and have a 4.5 percent coupon. The current price is quoted at 97.6. What is the yield to maturity?

|

|

The clean price of the bond must equal the bonds dirty price

: What condition must exist if a bond’s coupon rate is to equal both the bond’s current yield and its yield to maturity? Assume the market rate of interest for this bond is positive. The clean price of the bond must equal the bond’s dirty price.

|

|

Find beta from yahoo finance and value line for your firm

: Find the beta from Yahoo Finance and Value line for your firm. Perform a regression using stock returns versus the appropriate market return.

|

|

How much must stacey deposit in her margin account in order

: Assume the current spot price for crude oil is $63.15 per barrel and the futures price for crude oil is $63.20 per barrel. A futures contract is for 1000 barrels. On Monday, Stacey buys one futures contract from Ben. How much must Stacey deposit in h..

|