Reference no: EM13486730

Cosgrove Company manufactures two products, Product K-7 and Product L-15. Product L-15 is of fairly recent origin, having been developed as an attempt to enter a market closely related to that of Product K-7. Product L-15 is the more complex of the two products, requiring 2.0 hours of direct labor time per unit to manufacture compared to 1.0 hour of direct labor time for Product K-7. Product L-15 is produced on an automated production line.

Overhead currently is applied to the products on the basis of direct labor-hours. The company estimated it would incur $510,000 in manufacturing overhead costs and produce 10,000 units of Product L-15 and 40,000 units of Product K- 7 during the current year.

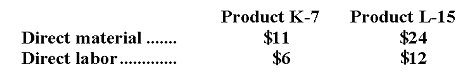

Unit costs for materials and labor are:

Required:

a. Compute the predetermined overhead rate under the current method, and determine the unit product cost of each product for the current year.

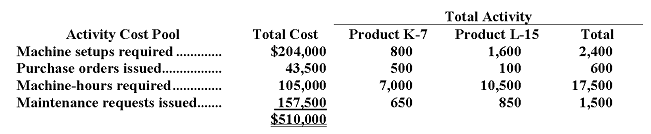

b. The company is considering the use of activity-based costing as an alternative to its traditional costing method for manufacturing overhead. Data relating to the company's activity cost pools for the current year are given below:

Using the data above, determine the unit product cost of each product for the current year.

c. What items of overhead cost make Product L-15 so costly to produce according to the activity-based costing system? What influence might the activity-based costing data have on management's opinions regarding the profitability of Product L-15?