Reference no: EM131421135

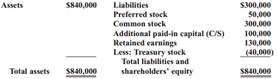

The balance sheet of Alex Bros. follows:

Of the 200,000 common shares authorized, 50,000 shares were issued for $8 each when the company began operations. There have been no common stock issuances since; 45,000 shares are currently outstanding, and 5,000 shares are held in treasury. Net income for the year just ended was $45,000. REQUIRED:

a. Compute the par value of the issued common shares.

b. Compute the book value of each common share.

c. At what average price were the treasury shares purchased?

d. Alex is considering reissuing the 5,000 treasury shares at the present market price of $10 per share. What effect would this action have on the company's debt/equity ratio, book value per outstanding share, and earnings-per-share ratio?

|

Final height of the tower

: An iron tower in is 527 feet tall on a cold day (T = -9 degrees Celsius). What is its final height (total) of the tower on a hot day when the temperature is 33.4 degrees Celsius?

|

|

Maximum speed of the ball

: A 0.050kg ball at the end of a string rotates at constant speed in a vertical circle with a radius of 0.23m. What is the maximum speed of the ball so that the tension is not to exceed 11N?

|

|

Cash flows for a capital project

: Given the following cash flows for a capital project, calculate the Payback period, NPV, PI, IRR, and MIRR. The required rate of return is 8 percent.

|

|

What might lambert’s external auditors think

: Provide the journal entry to record the preferred stock issuance, and compute the resulting debt/equity ratio, assuming that the preferred stock is considered an equity security.

|

|

Compute the par value of the issued common shares

: Alex is considering reissuing the 5,000 treasury shares at the present market price of $10 per share. What effect would this action have on the company's debt/equity ratio, book value per outstanding share, and earnings-per-share ratio?

|

|

What is the momentum of the softball

: A 425-g softball is travelling at 18.6 m/s [214 degrees]. a) What is the momentum of the softball? b) Determine the x-and y-components of the softballs momentum.

|

|

How can leaders and their leadership styles impact

: How does ethics impact business relationships within an organization? How can leaders and their leadership styles impact the ethical practices within an organization? How does ethics impact an organization's overall culture?

|

|

Problems involving vectors

: The momentum of a 75-kg dart is 9.00 kg*m/s east. What is the velocity of the dart? As with all problems involving vectors, remember to include the direction in your answer.

|

|

Why do we use more ac versus dc

: 1. How do we obtain a positive ion and a negative ion? Give an example. 2. Why do we use more AC versus DC?

|