Reference no: EM131837525

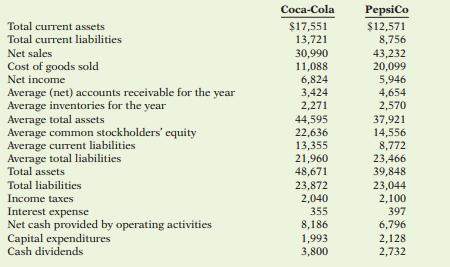

Question: The Coca-Cola Company and PepsiCo, Inc. provide refreshments to every corner of the world. Suppose selected data from recent consolidated financial statements for The Coca-Cola Company and for PepsiCo, Inc. are presented here (in millions).

Instructions: (a) Compute the following liquidity ratios for Coca-Cola and for PepsiCo and comment on the relative liquidity of the two competitors.

(1) Current ratio.

(2) Accounts receivable turnover.

(3) Average collection period.

(4) Inventory turnover.

(5) Days in inventory.

(b) Compute the following solvency ratios for the two companies and comment on the relative solvency of the two competitors.

(1) Debt to assets ratio.

(2) Times interest earned.

(3) Free cash flow.

(c) Compute the following profitability ratios for the two companies and comment on the relative

profitability of the two competitors.

(1) Profit margin.

(2) Asset turnover.

(3) Return on assets.

(4) Return on common stockholders' equity.