Reference no: EM132371832

FINANCIAL MANAGEMENT ASSESSMENT

Instruction : This Assessment is open-book, and you may use your textbooks, other supporting material, and Excel financial formulae for your reference and assistance.

Please Answer ALL FIVE Questions.

1. Premium Pie Company needs to purchase a new baking oven to replace an older oven that requires too much energy to run. The industrial size oven will cost $1,200,000. The oven will be depreciated on a straight-line basis over its six-year useful life. The old oven cost the company $800,000 just four years ago. The old oven is being depreciated on a straight-line basis over its expected ten-year useful life.

(That is, the old oven is expected to last six more years if it is not replaced now.) Due to changes in fuel costs, the old oven may only be sold today for $100,000. The new oven will allow the company to expand, increasing sales by $300,000 per year. Expenses will also

decrease by $50,000 per year due to the more energy efficient design of the new oven. Premium Pie Company is in the 40% marginal tax bracket and has a required rate of return of 10%.

a. Calculate the net present value and internal rate of return of replacing the existing machine

b. Explain the impact on NPV of the following:

i) Required rate of return increases

ii) Operating costs of new machine are increased

iii) Existing machine sold for less

2. Is it possible for a company that has negative net income, negative operating cash flow, and negative free cash flow to end the year with an increase in cash and an increase in stock price? Explain your answer. (Please write between 300-500 words)

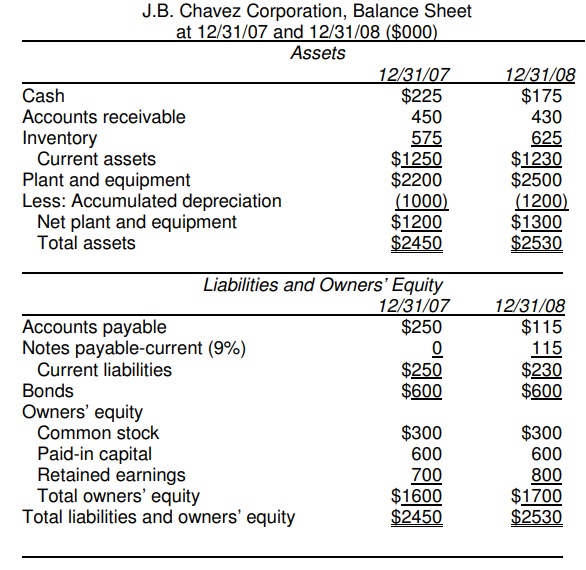

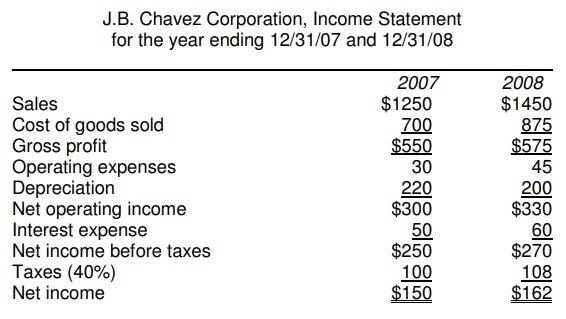

3. (Measuring Cash Flows) Given the information that follows, compute the free cash flows and financing cash flows for the J.B. Chavez Corporation for the year ended December 31, 2008.

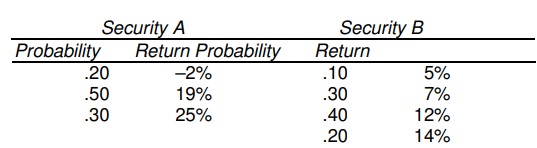

4. (Expected Rate of Return and Risk) Clevenger Manufacturing, Inc., has prepared the following information regarding two investments under consideration. Which investment should be accepted?

5. The manager of Golden Ray Corporation receives a bonus if company profits exceed $1,000,000 this year. During the final week of the year, the manager changes an accounting policy that will increase reported profits from $950,000 to $1,025,000, triggering his bonus. The change in profits of $75,000 will reverse itself in the next year, and the accounting change has no impact on Golden Ray's cash flow. Discuss the above situation as it relates to both an agency problem and efficient markets. (Please write between 300-500 words)

Reading :

CHAPTER 1: AN INTRODUCTION TO THE FOUNDATIONS OF FINANCIAL MANAGEMENT

CHAPTER 5: THE TIME VALUE OF MONEY

CHAPTER 9: COST OF CAPITAL

CHAPTER 13: DIVIDEND POLICY AND INTERNAL FINANCING