Reference no: EM13884236

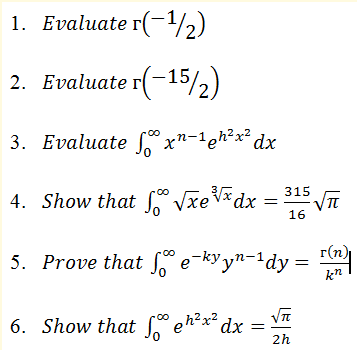

Q 1. You are given the following data on three securities, A, B, and the market, M:

a. Compute the correlation between A and the market, and B and the market.

b. Based on your answer to part (a), which of the two securities, A or B, is better to be combined into a portfolio with M? Explain briefly.

c. Compute the expected return and standard deviation for a portfolio formed between M and your choice in part (b). Then compute the weighted-average standard deviation of this portfolio and explain why the portfolio’s actual standard deviation is less than just holding any of the three securities, all of which have a standard deviation of 15% and an expected return of 10%.

d. Compute the systematic risk (ß) CAPM expected return for your choice in part (b). Why is it less than 10%? Explain in the context of systematic and total risk.

Q 2. You are given the following data for options on a common stock;

S=$102 X=$75 r=2.5% T=3 month δ=.2

a. Use the Black-Scholes Option Pricing Model to find the price of the options

i) Find  and d2=d1-δ√T

and d2=d1-δ√T

ii) Use your answers from a(i) to find N(d1) and N(d2) . Note: Round your answers to 2 decimal places before looking the values up in the tables.

(iii) Use the Black-Scholes OPM to find C

(iv) Use the put-call parity relationship to find the value of P.

b) State the intrinsic value and the speculative premium for the call and put options. Why is the speculative premium so small for each option?

3) A call option has a value of C=$5 and a put has a value of P=$3. Both options have an exercise price of X=$20. The options are to expire today.

a) Compute the payoff schedule for the call option using the following stock prices,S, and draw a graph of the payoff schedule.

|

S

|

10

|

15

|

20

|

25

|

30

|

|

Intrinsic Value

|

|

|

|

|

|

|

Payoff

|

|

|

|

|

|

b) g. Suppose that you buy the share for $20, but you would like to hedge your downside risk. Choose either the call or put option to eliminate some of the potential loss, and complete the table below. State what the resulting payoff schedule looks like.

|

S

|

10

|

15

|

20

|

25

|

30

|

|

Gain/loss on share

|

|

|

|

|

|

|

Intrinsic Value (Call or Put)

|

|

|

|

|

|

|

Payoff

|

|

|

|

|

|

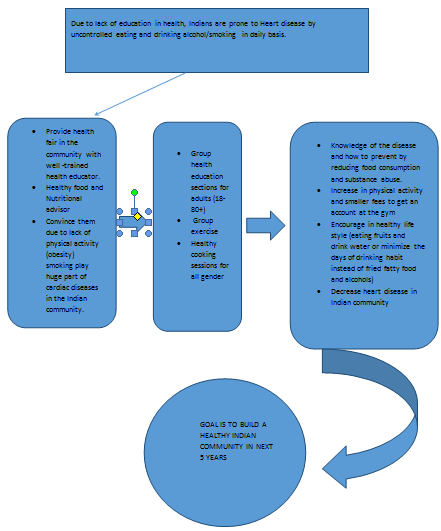

4. Provide a description of the three forms of the Efficient Market Hypothesis using the picture below. Do you think the markets are efficient?

Look at the graph below