Reference no: EM132363797

Questions -

Q1. Discuss the three plausible reasons why stock prices tend to decline following the announcement of a new equity issue, but tend to rise following a debt announcement.

Q2. What are the advantages and disadvantages of "going public" (i.e., selling shares to the general public)?

Q3. WUV Ltd. wants to raise $3.29 million via a rights offering. The company currently has 420,000 shares of common stock outstanding that sell for $30 per share. Its underwriter has set a subscription price of $25 per share and will charge WUV a 6% spread. If you currently own 6,000 shares of stock in the company and decide not to participate in the rights offering, how much money can you get by selling your rights?

Q4. a. Using the M&M Proposition II without taxes and security market line, we can derive the relationship among equity beta, asset beta, and capital structure. Write out this formula.

b. Using this formula, explain the meanings of business risk and financial risk. D/E increases with the increase in borrowing . Which directly increase the risk of borrowing or Financial Risk?

c. Explain, in words, the relationship among business risk, financial risk, and the cost of equity.

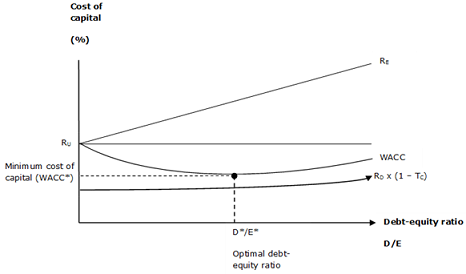

Q5. Explain the static theory of capital structure using the graph below. Describe the meaning of each term (RU, RE, WACC*, RDx(1-Tc), and D*/E*) on the graph below.

Q6. DEF Company is comparing three different capital structures. Plan I would result in 800 shares of stock and $9,000 in debt. Plan II would result in 700 shares of stock and $13,500 in debt. Plan III is an all-equity plan and would result in 1,000 shares of stock. The firm's EBIT will be $8,000 per year until infinity. The interest rate on the debt is 10%.

a. Ignoring taxes, compute the EPS for each of the three plans. Which of the three plans has the highest EPS? Which has the lowest?

b. Compute the break-even EBIT that will cause the EPS on Plan I to be equal to the all-equity EPS.

c. Compute the break-even EBIT that will cause the EPS on Plan II to be equal to the all-equity EPS.

d. Compare your results from parts (b) and (c) above. Is one higher than the other? Why?

e. Ignoring taxes, what is the break-even EBIT that will cause the EPS on Plan I to be equal to the EPS on Plan II? What conclusions do you reach when you compare the outcomes of parts (b), (c), and (e) above?

Q7. Q Corporation and R Inc. are two companies with very similar characteristics. The only difference between the two companies is that Q Corp. is an unlevered firm, and R Inc. is a levered firm with debt of $5 million and cost of debt of 10%. Both companies have earnings before interest and taxes (EBIT) of $2 million and a marginal corporate tax rate of 40%. Q Corp. has a cost of capital of 15%.

a. What is Q's firm value?

b. What is R's firm value?

c. What is R's equity value?

d. What is Q's cost of equity capital?

e. What is R's cost of equity capital?

f. What is Q's WACC?

g. What is R's WACC?

h. Compare the WACC of the two companies. What do you conclude?

i. What principle have you proven in this case?

j. Both companies are now evaluating a project that requires an initial investment of $1.15 million and that will yield cash inflows of $500,000 per year for the next three years. Assume that this project has the same risk level as the individual firm's assets. Should Q invest in this project? Should R invest in this project?

k. Based on your results for part (j), discuss the effects of leverage and its tax shields effects on the future value of the two firms.

Q8. Mr. Toriop owns 5,000 shares of stock in Yummy Corporation. The company has announced that it will pay a dividend of $5 per share in one year and a liquidating dividend of $50 per share in two years. The required return on Yummy stock is 12%.

a. What is the current share price of your stock?

b. What will be the company's share price in one year's time?

c. Mr. Toriop wishes to have equal amounts of dividend income for the next two years. How can he use homemade dividends to achieve this goal? Check that the present value of the cash flows will be the same as it is before the homemade dividends. (Hint: Dividends will be in the form of an annuity.)

d. Suppose Mr. Toriop is thinking about buying a house for $220,000 in one year. How can he use homemade dividends to achieve this goal? Check that the present value of the cash flows will be the same as it is before the homemade dividends.

e. Suppose Mr. Toriop is thinking about postponing the house purchase for two years, by which time the price of the house will have increased by $46,800. How can he use homemade dividends to achieve this goal? Check that the present value of the cash flows will be the same as it is before the homemade dividends.

Q9. One argument for high dividend payout is the desire of investors for current income. Explain why this argument does/does not work in a perfect capital market with no transaction costs. Explain how this argument does/does not work in real life.

Q10. The management of Oodles of Noodles Inc. is contemplating a 30% stock dividend. The company currently has cash of $250,000, fixed assets of $5 million, and debt of $3 million. Its net income for the most recent fiscal year was $800,000. The company's shares are currently selling for $25 per share, and it has 1 million shares outstanding. Assume that there are no costs associated with issuing a stock dividend.

a. What would be the effect of such a stock dividend on the following?

i. Number of shares outstanding

ii. Earnings

iii. Market value of cash

iv. Market value of equity

v. Share price

vi. Earnings per share (EPS)

vii. Price-earnings ratio (P/E)

viii. Shareholders' wealth

b. If the company's management would like to hold its EPS within the range of 0.7 0.9, should the company go ahead with the stock dividend?

c. If the company's shareholders only care about their wealth and the P/E ratio, should the company go ahead with the stock dividend?