Reference no: EM131248170

Dealing with asset substitution:-

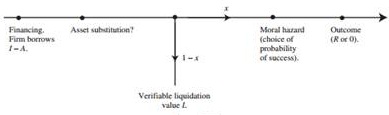

Consider the fixed-investment model with a probability that the investment must be resold (redeployed) at an intermediate date because, say, it is learned that there is no demand for the product. The timing is summarized in Figure 7.16. An entrepreneur has cash A and wants to invest a fixed amount I > A into a project. The shortfall must be raised in a competitive capital market. The project yields R with probability p and 0 with probability 1 - p, provided that there is a demand for the product (which has probability x and is revealed at the intermediate stage; the final profit is always 0 if there is no demand, and so it is then optimal to liquidate at the intermediate stage).

Investors and entrepreneur are risk neutral, the latter is protected by limited liability, and the market rate of interest is 0.

(i) In a first step, ignore the possibility of asset substitution. The liquidation value is L = L0, and the probability of success is pH if the entrepreneur works and pL = pH - ?p if she shirks (in which case she obtains a private benefit B). Assume that the NPV of the project is positive if the entrepreneur works, and negative if she shirks. Assume that A ≥ A, where

- Interpret (1).

- Compute the entrepreneur's expected utility.

- What is the class of optimal contracts (or, at least, characterize the optimal contract for A = A)? (ii) Suppose now that, before the state of demand is realized, but after the investment is sunk, the entrepreneur can engage in asset substitution. She can reallocate funds between asset maintenance (value of L) and future profit (as characterized by the probability of success, say). More precisely, suppose that the entrepreneur chooses L and

- the probability of success is pH + τ(L) if the entrepreneur behaves and pL + τ(L) if she misbehaves;

- the function τ is decreasing and strictly concave;

- the entrepreneur secretly chooses L (multitasking). Consider contracts in which

- liquidation occurs if and only if there is no demand (hence, with probability x);

- the entrepreneur receives rb(L) if the assets are liquidated, and Rb if they are not and the project is successful (and 0 if the project fails)

Interpret (2). Compute the minimum level of A such that the threat of (excessive) asset substitution is innocuous. Interpret the associated optimal contract. (Hint: what is the optimal asset maintenance (liquidation value)? Note that, in order to induce the entrepreneur to choose this value, in the case of liquidation you may pay rb(L) = rb if L is at the optimal level and 0 otherwise.)

|

Design-implement-test and debug a visual basic

: Design, implement, test, and debug a Visual Basic® program to create an enhanced aquarium calculator based on Week Two. Use that program and add these new features.

|

|

Explain the difference between three types of interest group

: Explain the difference between three types of interest groups. Provide examples of each. Which type of interest group do you believe has the most influence over US politics? Explain why.

|

|

Adutiting and assurance services

: List the major internal controls that were absent within Koss Corporation's internal control system? What internal controls should have been implemented or applied to ensure proper controls over the company's recorded transactions?.

|

|

Different about medical software systems

: What is different about medical software systems as compared to home systems? Why are these differences of importance to the medical office in terms of compliance?

|

|

Compute the entrepreneurs expected utility

: Compute the entrepreneur's expected utility. - What is the class of optimal contracts (or, at least, characterize the optimal contract for A = A)?

|

|

How can i validate the accuracy of my statement

: How can I validate the accuracy of my statement? How is this information relevant? How does my conclusion address the complexities of the issue? What is another interpretation or viewpoint of the issue?

|

|

Efficiency variances for direct labour and direct materials

: Assume that you manage your local Marble Slab Creamery ice cream parlour. In addition to selling ice cream cones, you make large batches of a few flavours of milk shakes to sell throughout the day. Your parlour is chosen to test the company’s “Made-f..

|

|

How you proceed in advocating for your proposed policy

: Explain whether your proposed policy could be enacted through a modification of existing law or regulation or the creation of new legislation/regulation. Explain how existing laws or regulations could affect your advocacy efforts. Be sure to cite..

|

|

Develop policy argument that is definitive using crime

: Develop a policy argument or claim that is definitive, designative, evaluative, and advocative, using one of these terms: (a) crime, (b) pollution, (c) terrorism, (d) quality of life, (e) global warming, (f) fiscal crisis.

|