Reference no: EM131337188

Capital Budgeting and Risk Analysis

ZeeBancorp is considering the establishment of a contract collection service subsidiary that would provide collection services to small- and medium-size firms. Compensation would be in the form of a percentage of the amount collected. For amounts collected up to $100, the fee is 55 percent of the amount collected. For amounts collected between $100 and $500, the fee would be 40 percent of the total amount collected on the account. For amounts collected over $500, ZeeBancorp would receive 35 percent of the total amount collected on the account.

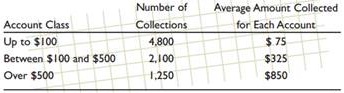

ZeeBancorp expects to generate the following amount of business during the first year of operation of the new subsidiary:

Over the projected 10-year life of this collection venture, the number of accounts in each group is expected to grow at 6 percent per annum. The average amount collected from each account is expected to remain constant.

To establish the collection subsidiary, ZeeBancorp will have to rent office space at a cost of $250,000 for the first year. (Assume the rent is payable at the end of each year.) This amount is expected to grow at a rate of 11 percent per year. Other operating expenses (excluding depreciation) are expected to total $350,000 during the first year and grow at an 11 percent annual rate. ZeeBancorp will have to invest $150,000 in net working capital if it undertakes this venture. In addition, required new equipment will cost $275,000 to purchase and an additional $25,000 to install. This equipment will be depreciated using the MACRS schedule for a 7-year asset. The salvage value for the equipment is estimated to be $50,000 at the end of 10 years. The firm's marginal tax rate is estimated to be 40 percent over the project's life, and its average tax rate is projected to be 35 percent over the project's life. The firm requires a 15 percent rate of return on projects of average risk.

1. Compute the net investment required to establish the collection subsidiary.

2. Compute the annual net cash flows over the 10-year life of the project.

3. Compute the net present value of this project assuming it is an average-risk investment.

4. Should ZeeBancorp invest in the new subsidiary?

5. ZeeBancorp requires all expansion projects such as this to have a payback of four years or less. Under these conditions, should ZeeBancorp invest in the new subsidiary?

6. If management decides that this project has above-average risk and hence the required return is 20 percent, should the investment be made?

7. If collections are only 80 percent of projections and the required return is 20 percent, should the investment be made?

8. If operating (excluding depreciation) and lease expenses are expected to increase at an annual rate of 13 percent, should the collection subsidiary be established, assuming a required return of 20 percent and the original revenue projections?

|

What other factors might be important in your analysis

: What is the probability that this project will be acceptable to BBW, if the goal is to maximize shareholder wealth?- What other factors might be important in your analysis? Be specific.

|

|

Measure entrepreneurial orientation

: Explain how management of Xiaomi inc can measure entrepreneurial orientation within their organisation. Critically appraise and discuss the organisation's entrepreneurial orientation.

|

|

Determine uptons self-supporting growth rate

: Upton Computers makes bulk purchases of small computers, stocks them in conveniently located warehouses, ships them to its chain of retail stores, and has a staff to advise customers and help them set up their new computers. Using the AFN equation, d..

|

|

What motivates them to undertake cpd activities

: There were four research questions. These are as follows; What motivates them to undertake CPD activities? What strategies do they consider in enhancing your CPD activities

|

|

Compute the annual net cash flows over the 10 year

: Compute the net investment required to establish the collection subsidiary.- Compute the annual net cash flows over the 10-year life of the project.

|

|

Think contain statistical analysis

: Search for three papers in your area of study that you think contain statistical analysis. Then, in a written response, address the following: Q1) What is the importance of statistical data analysis?

|

|

Tax savings from financing the project with a mortgage

: Your firm is in a 40% combined federal and state marginal income tax bracket. Your annual income is $500, 000 per year for two years. If you finance some project with a $1.3 million mortgage at an interest rate of 8%, how much will Uncle Sam receive?..

|

|

Negative effect as a business strategy

: Discuss how collusion can have a negative effect as a business strategy. Give an actual example of a collusion strategy used by a company.

|

|

Identify the television show or recent movie you watched

: The success of a product or a company in the marketplace is highly dependent on the target markets ability to distinguish a given product from another. One way this is accomplished is through branding. When it comes to branding, companies must mak..

|