Reference no: EM131410942

Hughes International is a U.S. company that conducts business throughout the world. Listed below are selected transactions entered into by the company during 2011.

1. Sold merchandise to Royal Equipment Company (a United Kingdom company) in exchange for an account receivable in the amount of 320,000 pounds. At the time, the exchange rate was 0.50 British pound per U.S. dollar.

2. Sold merchandise to Honda Automobile Company (a Japanese company) in exchange for a note receivable that calls for a payment of 350,000 yen. The exchange rate was 125 yen to the U.S. dollar.

3. Purchased inventory from Venice Leathers (an Italian company) in exchange for a note payable that calls for a payment of 500 euros. The exchange rate was 0.75 euro to the U.S. dollar.

4. Purchased inventory from B. C. Lumber (a Canadian company) in exchange for an account payable in the amount of 200,000 Canadian dollars. The exchange rate was 1.10 Canadian dollars per U.S. dollar.

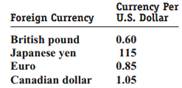

On December 31, 2011, the exchange rates were as follows:

REQUIRED:

a. Convert each transaction above to the equivalent amount in U.S. dollars.

b. Prepare journal entries to record each transaction.

c. Assume that the receivables and payables are still outstanding as of December 31, 2011.

Compute the amount of exchange gain or loss for each transaction.

d. Why do fluctuating exchange rates give rise to exchange gains and losses?

|

What else should you do the help the reader

: Read through your paper and look at the end of each paragraph and the beginning of the next. Is it obvious for the reader to see the connection? What types of transitions did you include-or will you include now and . In addition to being cons..

|

|

Transportation changes-communication developments

: This is the first 'modern' war for the United States. Technology such as rapid-fire guns, photography, railroads, telegraph, and even hot air balloons changed not only how we fought the war but also how it was documented, why we had such high deat..

|

|

Develop a project communication plan

: Develop a project communication plan to describe how stakeholders and managers will be kept informed regarding project progress. This will include the form of communication (status reports, meetings, etc.), frequency, and specific project mileston..

|

|

Which of the four methods would you recommend

: Acknowledging that some bias is inevitable when information is required on such short notice, which of the four methods would you recommend that the television station use to get the information it desires? Explain.

|

|

Compute the amount of exchange gain or loss

: Sold merchandise to Royal Equipment Company (a United Kingdom company) in exchange for an account receivable in the amount of 320,000 pounds. At the time, the exchange rate was 0.50 British pound per U.S. dollar.

|

|

Discuss building blocks of developing a market pay system

: Post on Building Blocks- Discuss the basic building blocks of developing a market competitive pay system, including the relationship between internal and external equity.

|

|

To study the effects of alcohol on decision making

: To study the effects of alcohol on decision making, a graduate student interviewed college students after they had left a campus bar. With a portable breathalyzer, he registered their blood alcohol levels

|

|

Types of bias played role in producing disastrous results

: Discuss the extent to which each of the following types of bias played a role in producing the disastrous results, if at all.

|

|

Demonstrated prewriting technique

: You will submit a project that includes a demonstrated prewriting technique, a topic sentence outline, and a draft essay that resulted from your prewriting and outline

|