Reference no: EM132287008 , Length: 6 pages

Project Objective

The goal of the project is to compute increasingly refined Risk Measures and evaluate their Out-Of-Sample performance. Let IS and OOS be the In-Sample and Out-Of-Sample periods, respectively. Consider the location-scale represen- tation of the log-returns rt:

rt = μt + σt · zt

Part A

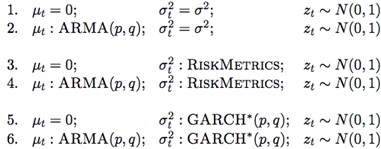

Use the IS period data to estimate the following specifications:

GARCH*indicates the best IS specification amongst the asymmetric EGARCH and GJR-GARCH (Hint: rank the various models and their parameterizations using Information Criteria).

• For all the above specifications (1-6) calculate OOS 1-period-ahead 5%, 1% and 0.1% VaRs and ES.

• Backtest your VaR and ES forecasts.

Part B

1. For the best IS specifications 1-2, 3-4 and 5-6 of Part A produce OOS ?1-period-ahead forecasts of the 5%, 1% and 0.1% VaRs and ES using: ?i. Extreme Value Theory?ii. Filtered Historical Simulations ?iii. Filtered Weighted Historical Simulations ?

2. Backtest your VaR and ES forecasts.

Part C

1. Produce OOS 1-period-ahead forecasts of the 5%, 1% and 0.1% VaRs and ES using: ?iv. Historical Simulations?v. Weighted Historical Simulations ?

2. Backtest your VaR and ES forecasts.

Part D

1. Produce OOS 20-, 60- and 120-periods-ahead forecasts of the 5%, 1% and 0.1% VaRs and ES for:

• The best IS specifications 1-2, 3-4 and 5-6 of Part A with Gaussian innovations. ?

• Specifications i.-iii. of Part B. ?

• Specifications iv.-v. of Part C. ?

2. Backtest your VaR and ES forecasts.

Report

Once you have completed the empirical analysis prepare a technical report dis- cussing and interpreting your findings. You should comment, among others, on the performance of the various approaches to VaR and ES and the sensi- tivity of the two risk measures to the specification/modeling of the conditional mean, variance and distribution. Include Tables and Figures to either help better support your analysis or to use as counter-examples. Do not include irrelevant material such as lines of code, etc.

Data

You are to perform your investigations on the returns of the Fama-French size and book-to-market portfolios. The IS and OOS periods are:

• IS: 20070103-20121231

• OOS: 20130102-20171130