Reference no: EM131535987

Question: Refer to Sanderson Company's financial information in Exercises II and I. Additional information about the company follows. To help evaluate the company's profitability, compute and interpret the following ratios for 2012 and 2011:

(1) return on common stockholders' equity,

(2) price-earnings ratio on December 31, and

(3) dividend yield.

Common stock market price, December 31, 2012 . . . . . . . . $15.00

Common stock market price, December 31, 2011 . . . . . . . . 14.00

Annual cash dividends per share in 2012 . . . . . . . . . . . . . . . . 0.30

Annual cash dividends per share in 2011 . . . . . . . . . . . . . . . . 0.15

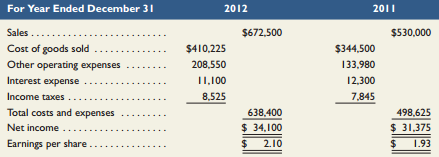

Exercises I: Refer to the Sanderson Company information in Exercise 17-7. The company's income statements for the years ended December 31, 2012 and 2011, follow. Assume that all sales are on credit and then compute:

(1) days' sales uncollected,

(2) accounts receivable turnover,

(3) inventory turnover, and

(4) days' sales in inventory. Comment on the changes in the ratios from 2011 to 2012. (Round amounts to one decimal.)

Exercise II: Sanderson Company's year-end balance sheets follow. Express the balance sheets in common-size percents. Round amounts to the nearest one-tenth of a percent. Analyze and comment on the results.

At December 31 2012 2011 2010

Assets

Cash . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 30,800 $ 35,625 $ 36,800

Accounts receivable, net . . . . . . . . . . . . . . . . . . . 88,500 62,500 49,200

Merchandise inventory . . . . . . . . . . . . . . . . . . . . 111,500 82,500 53,000

Prepaid expenses . . . . . . . . . . . . . . . . . . . . . . . . 9,700 9,375 4,000

Plant assets, net . . . . . . . . . . . . . . . . . . . . . . . . . . 277,500 255,000 229,500

Total assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $518,000 $445,000 $372,500

Liabilities and Equity

Accounts payable . . . . . . . . . . . . . . . . . . . . $128,900 $ 75,250 $ 49,250

Long-term notes payable secured by

mortgages on plant assets . . . . . . . . . . . . . . . 97,500 102,500 82,500

Common stock, $10 par value . . . . . . . . . . . . . . 162,500 162,500 162,500

Retained earnings . . . . . . . . . . . . . . . . . . . . . . . . 129,100 104,750 78,250

Total liabilities and equity . . . . . . . . . . . . . . . . . . $518,000 $445,000 $372,500