Reference no: EM131521730

Question: On January 1, 2012, Gundy Enterprises purchases an office for $250,000, paying $50,000 down and borrowing the remaining $200,000, signing an 8%, 30-year mortgage. Installment payments of $1,467.53 are due at the end of each month, with the first payment due on January 31, 2012.

Required: 1. Record issuance of the mortgage installment note on January 1, 2012.

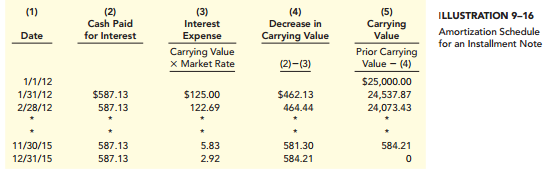

2. Complete the first three rows of an amortization schedule similar to Illustration 9-16 .

3. Record the first monthly mortgage payment on January 31, 2012. How much of the first payment goes to interest expense and how much goes to reducing the carrying value of the loan?

4. Total payments over the 30 years are $528,311 ($1,467.53 × 360 monthly payments). How much of this is interest expense and how much is actual payment of the loan?

|

Length is not normally distributed

: Suppose that the average pop song length in America is 4 minutes with a standard deviation of 1.25 minutes.

|

|

Examine potential changes in IT related to innovation

: Examine potential changes in IT related to innovation and organizational processes. List and describe internal (online) information security risks

|

|

How do you compute standard deviation

: How do you compute standard deviation? Just like in general. Lets say it gives me a list of outcomes and how frequent they happen in a give period.

|

|

How prepared are you to be part of a change effort

: How prepared are you to be part of a change effort in an organization? How will you be able to add value to that effort?

|

|

Complete the first three rows of an amortization schedule

: On January 1, 2012, Gundy Enterprises purchases an office for $250,000, paying $50,000 down and borrowing the remaining $200,000, signing an 8%, 30-year.

|

|

Summarize the article and provide an analysis

: Summarize the article, and provide an analysis of the author's main points. How does this article contribute to contemporary thinking about business ethics?

|

|

What is the probability that you missed the bus

: If you arrive to the bus stop at exactly 8:32am, what is the probability that you missed the bus?

|

|

Describe apples supplier responsibility information

: Describe Apple's Supplier Responsibility information. Provide detailed speaker notes of what you would say if you were delivering the presentation.

|

|

Conduct a phone or personal interview

: Conduct a phone or personal interview with a current or past manager. Ask this person to describe the role that training plays in the company

|