Reference no: EM13207969

Yankee, Inc., a U.S. based MNC, has recently decided to expand its international trade relationship by exporting to France. Bonjour Ltd., a French retailer, has committed itself to the annual purchase of 300,000 pairs of "Speedos," Yankee's primary product, for a price of EUR120 per pair. The agreement is to last for two years, at which time it may be renewed by Yankee and Bonjour.

In addition to this new international trade relationship, Yankee continues to export to Malaysia. Its primary customer there, a retailer called Leisure Products, is committed to the purchase of 270,000 pairs of Speedos annually for another two years at a fixed price of MYR450 per pair. When the agreement terminates, it may be renewed by Yankee and Leisure Products.

Yankee also incurs costs of goods sold denominated in MYR. It imports materials sufficient to manufacture 108,000 pairs of Speedos annually from Malaysia. These imports are denominated in MYR, and the price depends on current market prices for the components imported.

Under the two export arrangements, Yankee sells quarterly amounts of 75,000 and 67,500 pairs of Speedos to Bonjour and Leisure Products, respectively. Payment for these sales is made on the first of January, April, July, and October. The annual amounts are spread over quarters in order to avoid excessive inventories for the French and Malaysian retailers. Similarly, in order to avoid excessive inventories, Yankee usually imports materials sufficient to manufacture 27,000 pairs of Speedos quarterly from Malaysia. Although payment terms call for payment within two months of delivery, Yankee generally pays for its Malaysian imports upon delivery on the first day of each quarter in order to maintain its trade relationships with the Malaysian suppliers. Yankee feels that early payment is beneficial, as other customers of the Malaysian supplier pay for their purchases only when it is required.

Since Yankee is relatively new to international trade, Jim Johnson, Yankee's chief financial officer (CFO), is concerned with the potential impact of exchange rate fluctuations on Yankee's financial performance. Johnson is vaguely familiar with various techniques available to hedge transaction exposure, but he is not certain whether one technique is superior to the others. Johnson would like to know more about the forward market, money market, and options market hedges and has asked you, a financial analyst at Yankee, to help him identify the hedging technique most appropriate for Yankee. Unfortunately, no options are available for MYR, but EUR call and put options are available for EUR125,000 per option.

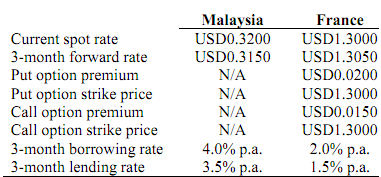

Jim Johnson has gathered and provided you with the following information for Malaysia and France:

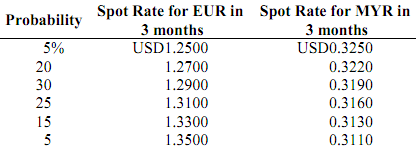

In addition to this information, Jim Johnson has informed you that the 3-month borrowing and lending rates in the United States are 2.5% p.a. and 2.0% p.a., respectively. He has also identified the following probability distributions for the exchange rates of the EUR and the MYR in three months:

Yankee's next sales to and purchases from Malaysia will occur one quarter from now. If Yankee decides to hedge, Johnson will want to hedge the entire amount subject to exchange rate fluctuations, even if it requires overhedging (i.e., hedging more than the needed amount). Currently, Johnson expects the imported components from Malaysia to cost approximately MYR300 per pair of Speedos. Johnson has asked you to answer the following questions for him:

1. Using an Excel spreadsheet, compare the hedging alternatives for the MYR with a scenario under which Yankee remains unhedged. Do you think Yankee should hedge or remain unhedged? If Yankee should hedge, which hedge is most appropriate?

2. Using an Excel spreadsheet, compare the hedging alternatives for the EUR receivables with a scenario under which Yankee remains unhedged. Do you think Yankee should hedge or remain unhedged? Which hedge is the most appropriate for Yankee?

3. In general, do you think it is easier for Yankee to hedge its inflows or its outflows denominated in foreign currencies? Why?

4. Would any of the hedges you compared in Question 2 for the EUR to be received in three months require Yankee to overhedge? Given Yankee's exporting arrangements, do you think it is subject to overhedging with a money market hedge?

5. Could Yankee modify the timing of the Malaysian imports in order to reduce its transaction exposure? What is the tradeoff of such a modification?

6. Could Yankee modify its payment practices for the Malaysian imports in order to reduce its transaction exposure? What is the tradeoff of such a modification?

7. Given Yankee's exporting agreements, are there any long-term hedging techniques Yankee could benefit from? For this question only, assume that Yankee incurs all of its costs in the United States.