Reference no: EM131112192

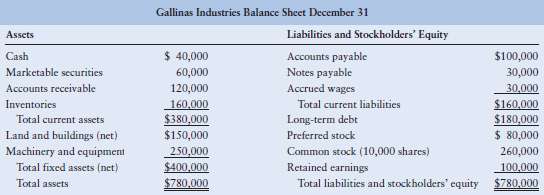

Book and liquidation value The balance sheet for Gallinas Industries is as follows.

�

Additional information with respect to the firm is available:

(1) Preferred stock can be liquidated at book value.

(2) Accounts receivable and inventories can be liquidated at 90% of book value.

(3) The firm has 10,000 shares of common stock outstanding.

(4) All interest and dividends are currently paid up.

(5) Land and buildings can be liquidated at 130% of book value.

(6) Machinery and equipment can be liquidated at 70% of book value.

(7) Cash and marketable securities can be liquidated at book value.

Given this information, answer the following:

a. What is Gallinas Industries' book value per share?

b. What is its liquidation value per share?

c. Compare, contrast, and discuss the values found in parts a andb.

|

Turning point for the effect of labour market experience

: Calculate and interpret the turning point for the effect of labour market experience on the log of the wage. Test whether an individual's ethnicity has a significant effect on their wage.

|

|

Providing security for the tcp-ip protocol suite

: Compare the three security protocols TLS, SSL and IPaec. Include in your analysis the information needed to engage in a discussion on the advantages and disadvantages of each protocol from these particular points of reference

|

|

Invest in a new machine that will increase the dividend

: Do nothing, which will leave the key financial variables unchanged. Invest in a new machine that will increase the dividend growth rate to 6% and lower the required return to 14%.

|

|

Use the data given to estimate its common stock value

: For each of the firms shown in the following table, use the data given to estimate its common stock value employing price/earnings (P/E)multiples.

|

|

Compare, contrast, and discuss the values found in parts

: What is Gallinas Industries' book value per share? What is its liquidation value per share? Compare, contrast, and discuss the values found in parts a andb.

|

|

What effect would this finding have on your responses

: Use the free cash flow valuation model to estimate CoolTech's common stock value per share. Judging on the basis of your finding in part a and the stock's offering price, should you buy the stock? On further analysis, you find that the growth rate in..

|

|

Find nabor industries'' common stock value

: Estimate the value of Nabor Industries' entire company by using the free cash flow valuation model. Use your finding in part a, along with the data provided above, to find Nabor Industries' common stock value. If the firm plans to issue 200,000 share..

|

|

What is the firm''s value if cash flows are expected

: What is the firm's value if cash flows are expected to grow at an annual rate of 0% from now to infinity? What is the firm's value if cash flows are expected to grow at a constant annual rate of 7% from now to infinity?

|

|

Dividends are expected to grow

: Dividends are expected to grow at 8% annually for 3 years, followed by a 5% constant annual growth rate in years 4 to infinity. Dividends are expected to grow at 8% annually for 3 years, followed by a 0% constant annual growth rate in years 4 to infi..

|