Reference no: EM13917162

The financial statement of Wal-Mart Stores, Inc. revealed the following information regarding the firm’s income taxes:

Note 9. Taxes

Income from Continuing Operations

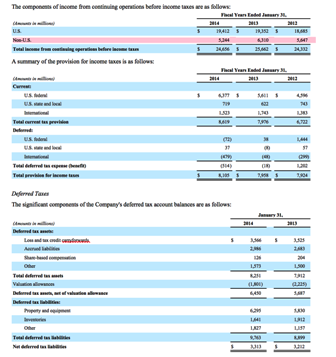

The components of income from continuing operations before income taxes are as follows:

a. Assuming that Wal-Mart had no significant permanent differences between book income and taxable income, did income before taxes for financial reporting exceed or fall short of taxable income for year ended 2012, 2013 and 2014? Explain.

b. Will the adjustment to net income for deferred taxes to compute cash flow from operations in the statement of cash flows result in an addition or a subtraction for2012, 2013 and 2014?

c. The company's accrued liabilities include accrued wages, self-insurance, accrued taxes, accrued utilities, and accrued interest etc. The company recognizes an expense and a liability for financial reporting for the accrued liabilities. However, they are expenses not yet deducted for tax purposes. Why are deferred taxes related to accrued liabilities disclosed as a deferred tax asset instead of a deferred tax liability?

d. For financial purposes, a company recognizes share-based compensation expenses during vesting period (from the grant date to the vesting date) based on the grant date fair value of the award. Under current tax law, the company receives a compensation expense deduction related to share-based compensation only when those options are exercised. Why are deferred taxes related to share-based compensation disclosed as a deferred tax asset?

e. Like most companies, Wal-Mart uses the straight-line depreciation method for financial reporting and accelerated depreciation methods for income tax purposes. Why are deferred taxes related to depreciation disclosed as a deferred tax liability?

|

Find the range variance and standard deviation

: Six different second-year medical students at Bellevue Hospital measured the blood pressure of the same person. The systolic readings (in mmHg) are listed below. Find the range, variance, and standard deviation for the given sample data

|

|

Decision tree analysis festus temperature control case study

: Decision trees are superb tools for helping you to select between several courses of action. They provide a highly effective structure in which you can lay out options and investigate the possible outcomes of choosing those options. They also help..

|

|

Raw materials budgeted to be purchased

: The raw materials budgeted to be purchased for the period is equal to.

|

|

Calculate the exponential expression

: let X be exponentially distributed with rate λX. Given X = u, let Y be a Poisson random variable of rate u. (a) Calculate the expression for fX|Y (u|0) in closed form and draw it as a function of u (hint: try not to calculate any integrals).

|

|

Company recognizes an expense and a liability

: The company's accrued liabilities include accrued wages, self-insurance, accrued taxes, accrued utilities, and accrued interest etc. The company recognizes an expense and a liability for financial reporting for the accrued liabilities.

|

|

Operating budget depends

: The operating budget depends on key information developed in the..

|

|

Define and use global named constants

: If you are using the Citrix remote lab, follow the login instructions located in the iLab tab in Course Home.Locate the Visual Studio 2010 icon and launch the application.

|

|

Perform the arithmetic operations

: Convert the following numbers into binary and perform the arithmetic operations in (i) and (ii) using signed binary numbers with 2's complement. Use 7 bits to represent the integer part of decimal numbers and the sign bit. Use three bits to repres..

|

|

Create a histogram and polygon using the commuting data

: Select a column of data other than Commuting Time from the STATES data file and create a Histogram and Polygon using the Commuting data as an example. 150 points (50 extra) will be assigned for completing this task

|