Reference no: EM131118113

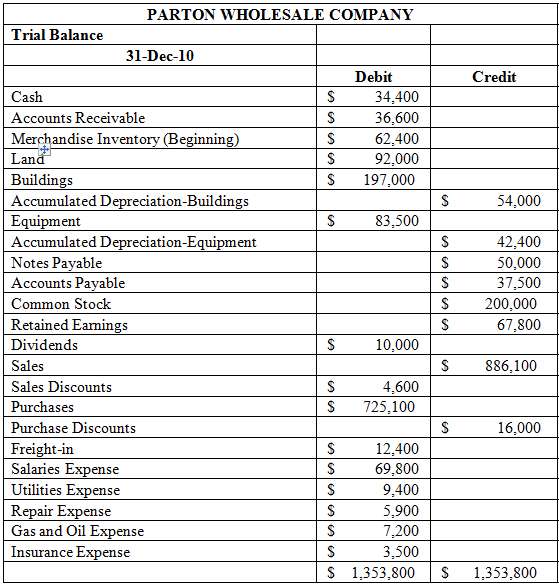

The trial balance of the Parton Wholesale Company contained the following accounts at December 31, 2010 the end of the company's calendar year.

Adjustment data:

1. Depreciation is $10,000 on buildings and $9,000 on equipment. (Both are administrative expenses.)

2. Interest of $7,000 is unpaid on notes payable at December 31.

Other data:

1. Merchandise inventory on hand at December 31, 2010 is $90,000.

2. Salaries are 80% selling and 20% administrative.

3. Utilities expense, repair expense, and insurance expense are 100% administrative.

4. $15,000 of the notes payable are payable next year.

5. Gas and oil expense is a selling expense.

6. The beginning balance of accounts receivable is $34,750.

7. The amount of total assets at the beginning of the year is $469,225.

Instructions

1) Journalize the adjusting entries.

2) Prepare a multiple-step income statement and a retained earnings statement for the year ended, as well as a classified balance sheet as of December 31, 2010.

3) Prepare the following ratios and show all support for your computations:

a) Current Ratio

b) Quick Ratio

c) Working Capital

d) Accounts Receivable Turnover

e) Average Collection Period

f) Inventory Turnover

g) Days in Inventory

h) Debt to Total Assets Ratio

i) Gross Profit Ratio

j) Profit Margin Ratio

k) Return on Assets Ratio

l) Asset Turnover Ratio

4) Based on the ratios computed in 3) above, answer the following questions and use the financial statement ratios to support your answers where appropriate:

Do you feel that the company is able to meet its current and long term obligations as they become due?

• Comment on the profitability of the company with respect to the various profitability ratios that you computed.

• Would you lend money to this company for the long term?

• Comment on the ability of the company to collect its receivables and mangeinventory

|

Problem regarding the examples of communications

: Compare and contrast how each company approaches marketing. Briefly describe each company and discuss whether each brand integrates differentiation into its marketing communications. Share examples of communications and evaluate their effectivenes..

|

|

A new test designed to have a mean

: A new test was designed to have a mean of 80 and a standard deviation of 10. A random sample of 20 students at your school take the test, and the mean score turns out to be 85. Does this score differ significantly from 80?

|

|

Test scores of these two groups significantly different

: You are conducting a study to see if students do better when they study all at once or in intervals. One group of 12 participants took a test after studying for one hour continuously.

|

|

Product back into the minds of the consumer

: Ones that customers dont know about. For those established product that have been around a while all they need to accomplish ads. Putting the product back into the minds of the consumer.

|

|

Comment on the profitability of the company

: Comment on the profitability of the company with respect to the various profitability ratios that you computed. Would you lend money to this company for the long term? Comment on the ability of the company to collect its receivables and mangeinventor..

|

|

Analyze how you use these power styles in each relationship

: Explain the power style you use when looking at your personal, family, and work life. Analyze how you use these power styles in each relationship.

|

|

Record the payment and interest

: Prepare the journal entry (ies) at December 31, 2010, to record the payment and interest (effective interest method employed).

|

|

Find the particular solution

: Find the particular solution to be differential equation dy/dx = xy + x which satisfies y=3 when x=0.

|

|

Calculate the p value for each pair based on the q value

: In an experiment, participants were divided into 4 groups. There were 20 participants in each group, so the degrees of freedom (error) for this study was 80 - 4 = 76. Tukey's HSD test was performed on the data.

|