Reference no: EM131206214

Question 1:

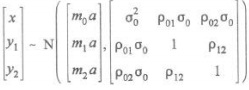

Consider an agency in which the outcome x is not publicly reported and the only public (verified) information that is reported is either y1 or y = (y1, y2). x, y1 and y2 are jointly normally distributed, and the two signals have been normalized so that they have unit variance:

Assume mo > 0 and σo > 0, Le., the agent's action influences the expected payoff and the payoff is uncertain. There are five other parameters: m1, m2, ∈[0, ∞] and ρ02, ρ02 ∈(+1, -1).

Action a is a choice variable and the set of actions A is a compact and convex set in [0, ∞).

Assume that the agent is strictly risk and effort averse, with

u1(c,a) = -exp[-r(c - a2)] c ∈ [0, ∞

Consider the following two settings:

(I) The principal is risk neutral and "owns" x.

(II) The principal is risk neutral and the agent "owns" x.

Required:

Answer the following questions for settings I and II,

(a) For what range of values for m1 and p01, is reporting y, strictly preferred to no report,

(b) For what range of values for m1, m2, p01, p02, and p12 is reporting y = (y1, y2) strictly preferred to reporting only y1.

Provide intuitive explanations of your results.

Question 2:

Consider the following agency problem:

Principal preferences: risk neutral

Agent preferences: u1(c,a) = 1/γ Cy - a2 y ∈(0, 1), c ∈ [0, ∞), a ∈ [0, ∞)

Beliefs: Φ(x|a) = x/a2 exp [-x/a] (i.e., Gamma of order 2)

Assume that x = y + ε, where y and ε are independently distributed with exponential distributions with mean a. Hence,

Φ(x|a) = 1/a2 0∫x exp[-x-y/a]exp[-y/a]dy = x/a2exp[-x/a]

Required:

(a) Derive Φ(x, y|a).

(b) Assume that both x and y are contractible information.

(i) Characterize the optimal compensation plan c(x, y).

(ii) Show either that y is or is not incentive informative given x.

(iii) Give an intuitive explanation of your result.

(c) Assume x is always contractible, but y is only contractible if the principal pays an information cost K. The principal can commit to an "investigation" strategy in which he specifies the values of x for which he will obtain y. Discuss the nature of the optimal compensation contract and investigation strategy for inducing a given action a > 0.

|

What real rate of return

: Lew's market invested in a project that returned 16.67 percent during a period when inflation averaged 3.26 percent. What real rate of return did Lew's earn on its project?

|

|

Will court allow leilani to sell the surfboards in fashion

: Will the court allow Leilani to sell the surfboards in this fashion? Please list the factors the court will look at in determining if this is proper. Please also discuss any objections that Cody may raise?

|

|

Local emergency management agency

: You work as an emergency manager for a small town that just created the position. As the local emergency management agency did not previously exist you are in charge of a new agency. What technology should you recommend for purchase and WHY? You..

|

|

What price does jefferson charge per unit

: The contribution margin per unit?At the break-even point, Jefferson Company sells 115,000 units and has fixed cost of $349,600. The variable cost per unit is $4.56. What price does Jefferson charge per unit?

|

|

Characterize the optimal compensation plan

: Discuss the nature of the optimal compensation contract and investigation strategy for inducing a given action a > 0 - Characterize the optimal compensation plan.

|

|

What seems to be edmundsons thesis or main claim

: What seems to be Edmundson's thesis, or main claim? What are his major pieces of evidence that support his claim? How persuasive is this evidence to you, and why? What does Edmundson want to do differently in higher education?

|

|

Develop an implementation plan for key objectives

: Analyze the structure, logistics, and facility location of the organization. Explain how the organization's structure, logistics, and facility location affects the organizational performance.

|

|

Evaluate strengths of us military during military encounters

: Evaluate the strengths of the U.S. military during major military encounters. Evaluate differences in the U.S. military during times of peace and war.

|

|

Effective annual rate

: The managers of Bank B want the rate on its money market accoun toequal Bank A's effective annual rate, but interest is to becompounded on a monthly basis. What simple, or quoted, rate mustBank B set?

|