Reference no: EM131221357

Global Strategy and International Management Assignment

Individual Case Analysis - Thai Beverage Public Company and the Russian Beer Market By: Musharraf Uwais, Mohamed

(1) Thai Beverage Public Company Limited ("ThaiBev") is Thailand's largest and regional leading beverage company, embodying commercial excellence and continuous product innovation. ThaiBev's business comprises of four segments - spirits, beer, non-alcoholic beverage, and food. They have vastly improved the sectors they trade since the beginning of the company, and has become one of the best beverage companies in all of Asia. ThaiBev is listed on the the Singapore Exchange since 2006. The market capitalisation of ThaiBev is currently over US$ 13 billion. (ThaiBev Private Company Limited, 2016)

ThaiBev has 125 subsidiaries (as of 31 December 2016), including 18 distilleries, 3 breweries and 10 non-alcohol beverage production facilities.ThaiBev has a prominent international presence in over 90 countries and engages in several distillery operations overseas; it has 5 production facilities in Scotland. ThaiBev also owns 1 distillery in China, which produces a famous Chinese spirit branded Yulinquan.In 2012, ThaiBev expanded its business overseas, and through the acquisition of Fraser and Neave, Limited, a highly renowned company in Singapore with a portfolio that boasts many renowned brands, ThaiBev has become the leading beverage producer and distributor in the ASEAN region. But not limited to the South Asian region ThaiBev supplies to UK, Africa,USA and Australia and many other countries in Europe and Americas.(ThaiBev Private Company Limited, 2016)

Looking at the company overview of ThaiBev we understand that they have been successful in the beverage industry ever since the owners acquired it from the Thai governmental organisation. Their revenue reported for the financial year 2015 was approximately US$523 Million. As an investment analyst it is my responsibility to conduct a detailed 'Resources analysis' and an 'Industry analysis' for ThaiBev to look at the performance of the company locally and to spot further domestic opportunities, if available to the company. And at the same time since the task requires us to specifically concentrate on the international expansion of ThaiBev into Russian beer market, I am going to narrow my analysis in to Beer Markets of Russia while I explore how ThaiBev can add more value to their company domestically and internationally expanding.

In the study of organisations, organisational ambidexterity appears to be one topic which brings out the awareness in companies as to how they can exploit and explore simultaneously to pursue development in operations and innovation of a business at the same time. I can clearly explain how and why that ThaiBev has been using the exact same concept in the expansion of their business. First Under the Resources Analysis of the company we can do a 'Value -Chain Analysis' to identify the structure of the company and how resources are available to the company.

(ThaiBev Private Company Limited, 2016)

As we can clearly see from the Value Chain diagram above, ThaiBev has the resources that it needs as a company to succeed in this trade. They use the best raw materials, and the factories have state of the art new equipment. They have expanded their production facilities within Thailand and in overseas venues to supply to the local markets as well as International markets. (Production facilities in Scotland and China),(ThaiBev Private Company Limited, 2016)Obviously there are benefits to having more production plants in the Asian region, and especially in Thailand and China due to added benefits such as low running costs and labour costs. ThaiBev has penetrated in to markets around the world, although most of the company's sales revenue comes from Thailand; about 94% and the rest of the 6% from its international sales. (Amonrat Thoumrungroje Olimpia C. Racela, 2013) On the other hand ThaiBev takes Marketing and Corporate Social Responsibility very seriously; sponsoring the Everton Football Club of the English Premier League was one such intelligent move. Also ThaiBev's agreement to sponsor Professional Golfers Association tour which was broadcasted to over 50 million households also marketed for ThaiBev's products immensely. (Amonrat Thoumrungroje Olimpia C. Racela, 2013) One of the most important qualities of ThaiBev as a successful business conglomerate is that it works in multiple sectors constantly innovating. Although the company was solely founded upon the goal of producing spirits, ThaiBev has conquered markets in all areas of Food and Beverages Industry. They have gone in toproduction Beer, Lager, Non-Alcoholic Beverages, Food and etc. Therefore we can conclude that ThaiBev is an ambidextrous organisation indeed.

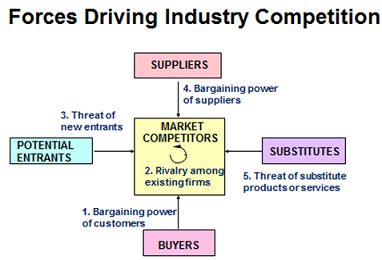

Since we have established now that ThaiBev has all the expertise in resources to excel in the markets and that they have the funds to reinvest in new projects through the incremental profits they have been earning, we should do an Industry- based analysis to understand what type of market ThaiBev is competing in, when it comes to Russian Beer Market. And from now on I am going to narrow down my discussion to ThaiBev Beer and Russian Beer Markets for the purpose of exquisitely answering the question at hand. We can simply use the 'Porter's Five forces framework' for this purpose.

Analysis of the Russian Beer Market,

|

5 Forces

|

Analysis

|

|

1.Bargaining power of buyers

|

Consumers are price sensitive due to the poor economic conditions of the country, Availability of cheaper choices (cheap priced vodka)

|

|

2.

Rivalry among the competitors

|

Carlsberg A/S (42.6% Market Share), Anadolu Efes Biracilik Ve Mait Sanaliya AS (20.9%), Anheuser-Busch InBev (14.6%)

|

|

3.Threat of new - entrants

|

Not so much, due to high entry fees, excise duties and tight regulations. The above existing firms have been dominating the markets for quite a while. FDI policy not so favourable for international players but can work with.

|

|

4.Bargaining power of supplier

|

There are few players who have an edge over others on account of being established players. (Top 3)

|

|

5. Threat of substitutes

|

Irrelevant, Competition is mainly against existing branded products in the market.

|

According to MarketLine issue on Beer in Russia, April 2015; Russian Beer markets have shown very strong growth from 2009-2013. The Beer market in Russia is worth US$25.1 Billion as at 2014. Beer markets had a CAGR of 7.6% from 2010-2014. When we look at the segmentation of the market Premium Lager has the highest demand (53.2% Total Market Value) and followed by Standard Lager. (37.8% Market Value) Russia accounts for 19.2% of the European Beer Market.

Taking all these analyses in to consideration including the Porter's Five Forces analysis we can come in to the conclusion that Russian Beer Market is an attractive market. My recommendation is that ThaiBev must make a collaborative effort with Carlsberg to get established in the Russian markets. Since Carlsberg has been the trusted brand of beer in Russia for years, this is one strategy that ThaiBev can use to penetrate in to the markets. As we can see from the Porters five forces analysis, Russians are sensitive to prices due to the on-going economic crisis is Russia, using the cost effective production bases in Asia and Scotland, ThaiBev can offer competitively low prices for their beer products, which is another strategy that can be used.

I believe that ThaiBev must indeed demonstrate strategic ambidexterity when it competes in Russia against other rivals in the beer markets, because through innovation in the market when ThaiBev gets acquainted to the environment of Russia, they can exploit the markets to earn higher profits by also producing regionally (premium lager, standard lager) desirable products for Russia to add value to the company. (Strongly concentrated beer due to extreme weather conditions)

(2) ThaiBev must conduct a PESTEL analysis before it can choose its Porter's Generic Strategy to compete in the Beer Consumption markets of Russia. It is important that the company has a substantive idea about the P-Political, E-Economic, S- Social, T- Technological, E- Ecological and L- Legal obligations, boundaries, challenges and responsibilities it has to face as a company in the foreign markets.

ThaiBev has been actively trading their beers in United States, UK and Europe. The company is familiar with processes of international trade. If we do a PESTEL analysis on the Russian Beer Market, it would look as follows;

|

Political

|

Belongs to European Union trade block, many taxes imposed on liquor products including extra excise duties, Foreign Direct Investments are not always favourable.

|

|

Economic

|

GDP Trends are important, Russian economy has been declining for a while now according to World bank reports. Economic conditions of individual has declined, hence the spending has reduced too.

|

|

Social

|

Life-Style changes have taken place due to economic changes. People are looking to live on a reduced budget. Cost cutting. Swapping to cheaper products.

|

|

Technological

|

No expansion seen in the beer sector due to the declining consumption.

|

|

Ecological

|

Strict environment protection regulations. But will not apply ThaiBev since not produced in Russia.

|

|

Legal

|

Very strict Laws on alcoholic- beverages, health and safety laws, licencing laws and etc.

|

Looking at the PESTEL analysis we understand that Russia has a moderately governed Beer market. Easy enter for a well-established company like ThaiBev. As we saw under the Value-Chain analysis this company has every opportunity to succeed in Europe especially with the production plants located in Scotland. Close proximity Russia allows low transportation costs and will also minimize the cost of distribution.

When we analysed the company using the Porter's Five Forces framework, we saw that people have gotten used to three major types products over time. ThaiBev cannot barge in to the Russian Beer Market and establish themselves as a major beer supplier, without the help of one of these three brands. ThaiBev will have to take a synergistic approach, collaborating with one of these brands to win the trust of the people. They can then consider effective advertising and corporate social responsibility methods win the hearts and the trust of the people to grow the business in Russia over Long-run.

I believe that ThaiBev must use Cost leadership Strategy under, Porter's Generic Strategy models. In cost leadership, a firm sets out to become the low cost producer in its industry. The sources of cost benefits are varied and mainly depend on the structure of the industry. The major concern here is, how ThaiBev can make use of economies of scale, proprietary technology, preferential access to raw materials and other factors. As we know a low cost producer must find and benefit from all sources of cost advantage. Through this entire process how can ThaiBev become a company which outperforms all beer companies in Russia?

ThaiBev has production plants all over the world. Since we are looking at minimizing the costs, we have to understand that production has to be moved to a place with low running costs and labour costs. As it is, ThaiBev's production in China is ideal for supplying to Russia. China is closer to Russia (shipping and distribution costs will be low), very low running costs for businesses in China and including very low labour costs. ThaiBev can use these very low prices of production costs to conquer the beer markets in Russia at a competitive level.

Since the Russians are adopting a low cost life-style due to the on-going financial decline in the country, a low cost but a quality product will be able to capture the desired demand for ThaiBev beer products. And with long-run they Thai-Bev will be able to increase prices when other competitors are submerged, and when they capture enough of the demand in the markets.

References -

1. ThaiBev Private Company Limited 2016,Always with you, accessed 6th August 2016,

https://thaibev.listedcompany.com/misc/SR/20160408-thaibev-sr2015-en.pdf

2. Sustainability Report of ThaiBev Private Company Limited 2016, accessed 6th August 2016,

https://www.thaibev.com/images2015/pdf/SRThaiBev2014-Eng.pdf

3. Amonrat Thoumrungroje Olimpia C. Racela, (2013),"Thai Beverage Public Company Limited: Thailand leader, global challenger", Emerald Emerging Markets Case Studies, Vol. 3 Iss 2 pp. 1-30

4. Market Line, Beer in Russia, April 2015 Issue.

Attachment:- Assignment Tips.rar