Reference no: EM131327581

WILSON INTERNATIONAL INTERNATIONAL CAPITAL BUDGETING

Wilson International is a chain of over 100 luxury hotels found mostly in developed countries.George Wilson,a former Chicago sales representative who frequently traveled internationally, started the company. As an international business traveler, Wilson found that hotel quality varied from country to country. He quit his very successful sales job and started a hotel in Dublin, Ireland, a country known for its extensive bed-and-breakfast industry. Wilson felt that business travelers needed a greater selection of hotels in Dublin, particularly in the higher-priced market.

The Wilson of Dublin was an immediate success with business travelers and, with the help of a venture capitalist, George was able to expand his hotel concept to 20 countries. Wilson has always sought hotel opportunities in more developed countries in Europe and Asia.George and his associates felt that the problems found in lessdeveloped countries presented too much risk for his company,thus they avoided most countries of the world.Because the countries in which Wilson operates are considered politically stable and present little political risk, the investment decisions are normally made on the basis of revenue projections using a net present value approach.The firm's cost of capital is used as a means of discounting expected cash flow.

If the net present value (NPV) of the investment is above zero, the hotel is constructed.This approach has worked well for the company over the years. With the possibility of market saturation beginning to rise, George is considering an opportunity to expand into other markets. He has been approached by a trade representative of St Charles, a small and moderately industrialized island in the Caribbean, who proposes that Wilson International build a business hotel in the capital, Dominic.

The trade rep has assured George that an additional hotel is needed in the capital because of the country's expanding industrialization.St Charles has always enjoyed a brisk tourist trade,and now the country is diversifying its economy into light manufacturing. Multinationals from the United States and Europe have established customer service operations on the island, and a number of garment manufacturers have begun operations there as well.

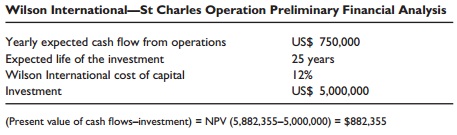

The trade representative tells George that managers from these companies frequently visit the island,and they need a more luxurious hotel in which to stay.The hotel would certainly be profitable, reasons the trade rep. Financial analysts for the company have created a report indicating that,using the present financial model, a small hotel would be a good investment. Data included in the model can be seen below.

Some Wilson analysts argue, however, that a higher discounting factor than cost of capital should be used. It is proposed by some that a more appropriate discounting factor would be 15 percent, because of the higher risks associated with the investment environment. George is uncertain about the proposed investment.While he sees the need for the company to find new markets, he is also troubled by reports he has read about increasing social unrest on the island.Although George and his associates do not consider St Charles to be a high-risk country, they are concerned about recent increases in petty street crime and social unrest.

It has been reported that citizens have resorted to violent street protest to express their displeasure with the increasing prices of some consumer goods.The currency of St Charles, the Caribbean dollar, has been devalued against most hard currencies of the world and, as a result, imported goods have increased in price. On the other hand, St Charles has no currency or foreign direct investment restrictions, and allows for full repatriation of company profits. In recent years, the government has been attempting to promote the island as an attractive location for foreign investment. With declining opportunities in more stable environments, George must consider the feasibility of this opportunity, and the necessary change of strategic direction it would mean for Wilson International.

CASE DISCUSSION

1. What additional information might be useful to consider before making this investment decision?

2. Can an international company avoid all political risk? Explain.

3. Would you recommend that Wilson International build a hotel on St Charles? Are there any alternatives to consider other than building the hotel or staying out of the country? Explain.