Reference no: EM1314244

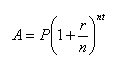

The formula for computing the amount of money returned for an initial deposit into a bank account or CD (certificate of deposit) is given by:

A is the amount of the return.

P is the principal amount initially deposited.

r is the annual interest rate (expressed as a decimal).

n is the number of compound periods in one year.

t is the number of years.

Carry all calculations to six decimals on each intermediate step, then round the final answer to the nearest cent.

Suppose you deposit $2,000 for 5 years at a rate of 8%.

[A.] Compute the return (A) if the bank compounds annually (n = 1).

[B.] Compute the return (A) if the bank compounds quarterly (n = 4). Final your answer to the nearest cent.

[C.] If a bank compounds continuously, then the formula used is A = pen

[D.] Does compounding annually or quarterly yield more interest? Explain why.

Where e is a constant & equals approximately 2.7183.

[E.] Compute A with continuous compounding. Round your answer to the nearest cent.

A commonly asked question is, “How long will it take to double my money?” At 8% interest rate & continuous compounding, what is the answer? Final your answer to the hundredth's place.