Reference no: EM13687615

Question 1:

Rachel Green, the owner-manager of a small business, had carefully monitored her cash position over the past financial year, and was pleased to note at the end of the year that the cash position was strong and had shown a healthy 50% increase over the year. When presented with the income statement for the year, she was dismayed to note that the profit earned in the last year had deteriorated significantly and had become a loss for the current financial year. In her anger, she accuses you of having made errors in the accounting records since "such a silly situation could not possible exist".

Draft a response to Rachel.

Question 2:

After calculating the current ratio of an entity and finding that the ratio's value was 5:1, a student analyst decided that the company was in a sound position for paying all its liabilities including all non-current liabilities. Discuss the shortcomings of making such a conclusion. Also outline some of the disadvantages of using ratio analysis only to evaluate a company's performance.

Question 3:

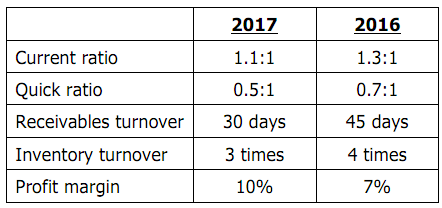

In analysing the financial statements of an entity, the following ratios were calculated:

What conclusion(s) can be made about the entity based on the above ratios?

Question 4:

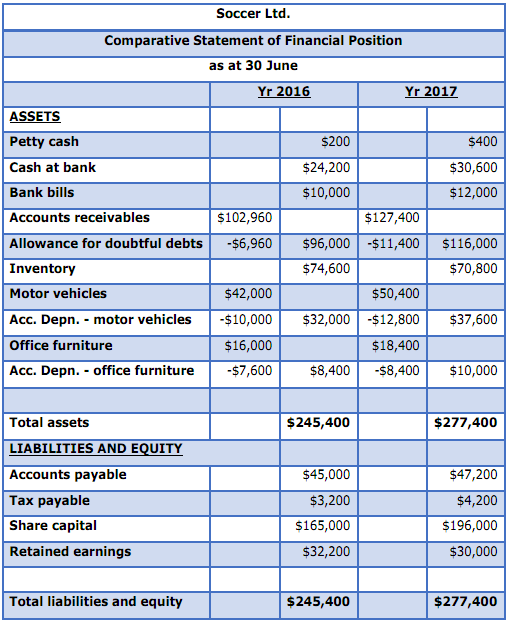

Below are the comparative statements of financial position of Soccer ltd:

Additional information:

1. Income statement details are: sales revenue $750,000, cost of sales $603,000, expenses $116,360 (excludes depreciation and carrying amount of vehicle sold), bad debt expense $14,440 and tax expense $4,200

2. A dividend was paid using the year

3. A vehicle that cost $5,600 originally was sold during the year for $3,000. The vehicle had been depreciated by $3,200 at date of sale.

4. The company pays income tax in one instalment. The single instalment of $3,200 due by 21 Oct 2016 was paid.

Required

Prepare a statement of cash flows for the year ended 30 June 2017 in accordance with the direct method. Provide all workings.

Question 5:

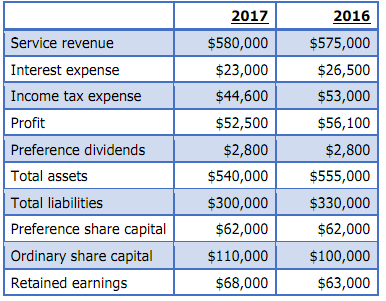

The following information has been extracted from the financial statement and notes of Reef Ltd:

Required: Evaluate the company's profitability and financial stability by calculating and analysing the relevant ratio(s).