Reference no: EM13913337

1. Elm, Inc. had the following income statement for last period:

Sales $50,000

Cost of Sales (manufacturing) 24,000

Selling and General Administrative 6,000

Net Income $20,000

If costs of sales was 75% variable and 25% fixed, and Selling and General Expense was 60% variable and 40% fixed, prepare a contribution format income statement and calculate its contribution margin percentage.

2. Sammy Company has a variable cost percentage of 40% on a product that sells for $50 per unit.

Fixed costs are $40,000. Sammy wants to know how many units must be sold to:

a) Break even

b) Earn a profit of $28,000

Ignore income taxes.

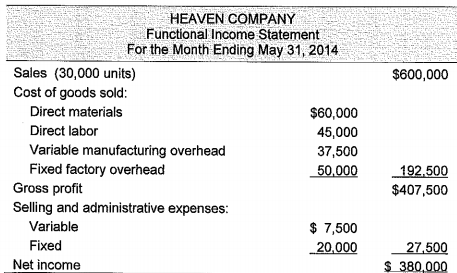

3. Heaven Company had the following functional income statement for the month of May, 2014:

Calculate Heaven's break-even sales in units.

4. The Top Cat Corporation has the following current data:

Selling price per unit $40

Variable costs per unit $15

Fixed costs $260,000

Units sold 25,000

Calculate Top Cat Corporation's current operating leverage.

5. The Top Cat Corporation has the following data for 2014:

Selling price per unit $25

Variable costs per unit $12

Fixed costs $60,000

Units sold 40,000

Calculate Top Cal's operating leverage at the end of 2014, assuming that 2014 sales decrease to 30,000 units.

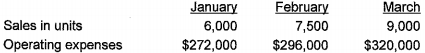

6. Portland Manufacturing had the following data for the past three months.

Using the high-low method, estimate Portland's total fixed costs, contribution margin ratio and break even point in sales dollars for April. Portland expects to sell 10,000 units for $50 per unit.

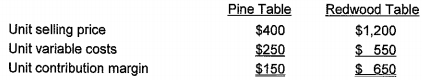

#7. Assume the Southeast Furniture Company sells two kinds of picnic tables, pine and redwood. At a 2:1 unit sales mix in which Southeast sells two pine tables for every redwood table, the following revenue and cost information is available.

Assuming a 2:1 sales mix, calculate Southeast Furniture's current monthly average unit contribution margin, break-even sales volume, and number of units of Pine and Redwood tables at break-even point.

#8. Ontario Outdoors is a manufacturer of outdoor items. The company is considering the possibility of offering a new sleeping bag that would sell for $150 each. Cost to manufacture these sleeping bags includes $40 in materials and $35 in direct labor for each sleeping bag. Variable marketing and selling costs would be $15 each. In order to manufacture these sleeping bags, the company would need to incur $120,000 in fixed costs for new equipment.

Required:

a. Compute the break-even point of the sleeping bag in units sold.

b. What would be the total revenue at the break-even point?

c. How many units would Ontario need to sell to earn a profit of $21,000?

d. If fixed costs in fact are $150,000 rather than $120,000, how many units would need to be sold in order to earn $21,000?