Reference no: EM13486399

PART A:

Part A of this assignment requires an analysis of certain aspects of "Brown Ltd"

After studying "Brown Ltd", answer the following questions:

Assuming that -

- Brown has no uncommitted internal funds which can be applied to financing the proposed expansion and replacement program;

- Brown will finance any funding shortfall (after the proposed capital restructuring) with new debt. Brown's cost of equity will remain at 11% after tax, irrespective of changes to its debt ratio (i.e. the ratio of market value of total long-term debt to market value of total long-term funds) -

Justify your answers to the following questions with full explanations, including, where applicable, itemised schedules of relevant capital structure components.

(a) Quantify Brown's debt ratio before and after the capital restructuring.

(b) Quantify Brown's WACC before and after the capital restructuring.

(c) What discount rate did you use to evaluate the investment alternatives offered by the proposed capital expansion and replacement program? Justify your answer.

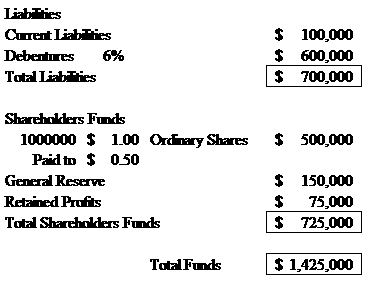

Existing Capital Structure

The present capital structure of the company is shown below. The current market value of the company's $1 ordinary shares paid to 50c is 85c. The company's debentures are currently quoted at their nominal value. On the basis of the above market value of ordinary shares the company's cost of equity capital is estimated at 11 per cent. Any new debt can be obtained at 7%.

Capital Structure as at 30 June 2011

Proposed Investment Program

Brown Plastics is planning to spend $700,000 on restructuring.

Proposed Changes to Capital Structure

The planned expansion and replacement program is to be financed partly by calling up the amount uncalled on the $1 ordinary shares. The reaction of the share market to the announcement of the planned expansion is expected to be favourable, and the market price per share is expected to rise to $1.45 per fully-paid share. Cost of equity capital is expected to remain at approximately 11 per cent despite this rise in market value of shares. Repayment of debentures with a total value of $300,000 is due and this is to be met partly from the call of 50c per ordinary share. Any additional financing will be sought through borrowings at the same cost as that of existing debt.

Additional Information

The current rate of company tax is 40 cents in the dollar.

PART B:

The company is considering the acquisition of equipment that would radically change its manufacturing process.

- The equipment would cost $3,500,000

- The equipment's useful life is projected to be seven years, and 30 per cent diminishing value depreciation would be used for tax purposes.

- The equipment requires software that will be developed over the first three years. However, the equipment would be fully functional from the beginning of the second year. Each software expenditure, which would amount to $75,000 per year, will be expensed during the year it is incurred.

- A computer systems operator would be hired immediately to oversee the operation of the new equipment. The operator's annual salary would be $86,000, plus on-costs of 40 per cent.

- Maintenance technicians would be needed. The total cost of their wages and on- costs would be $125,000 per year.

- The changeover of the manufacturing line would cost $180,000, to be fully expensed in the first year.

- Several of the company's employees would need retraining to operate the new equipment. The training costs are projected as follows:

First Year $35,000

Second Year $25,000

Third Year $10,000

- An inventory of spare parts for the robotic equipment would be purchased immediately at a cost of $60,000. This investment in working capital would be maintained throughout the life of the equipment. At the end the parts would be sold for $60,000.

- The equipment's salvage value is projected to be $75,000. It would be fully depreciated at that time.

- Apart from the costs specifically mentioned above, management expects that the equipment would save $1,200,000 per year in manufacturing costs.

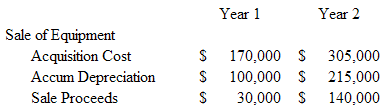

- Switching to the equipment would enable the company to sell some of its manufacturing machinery over the next two years. The following sales schedule is projected:

Calculate the Net Present Value and Internal Rate of Return.

PART C:

The Modigliani-Miller theorem, proposed by Franco Modigliani and Merton Miller, forms the basis for modern thinking on capital structure.

Explain and discuss their theorem along with a critique of the advantages and disadvantages of the theorem.

Part D.

Beyond Ltd management believes its optimal capital structure weights are as follows:

35% Long term Debt

15% Preference Shares

50% ordinary Share Capital

The firm is in the 40% tax bracket.

The firm's Investment Opportunities Schedule

|

Project

|

IRR

|

Initial Investment

|

|

A

|

14%

|

$300,000

|

|

B

|

25%

|

$400,000

|

|

C

|

17%

|

$600,000

|

|

D

|

14%

|

$500,000

|

|

E

|

19%

|

$300,000

|

|

F

|

16%

|

$800,000

|

|

G

|

15%

|

$400,000

|

Financing cost data is as follows:

Long-term debt:

The firm can raise $550 000 of additional debt by selling 15-year, $1000 par value, 9% coupon interest rate bonds that pay annual interest. It expects to net $960 per bond after flotation costs. Any debt in excess of $550 000 will have a before-tax cost, kd, of 13%.

Preference share capital:

Preference shares, regardless of the amount sold, can be issued with a $80 par value, 14% annual dividend rate and will net $75 per share after flotation costs.

Ordinary share equity:

The firm expects dividends and earnings per share to be $0.96 and $3.20, respectively, in 2008, and to continue to grow at a constant rate of 11.5% per year. The firm's shares currently sell for $14 per share. Beyond expects to have $1.75 million of retained earnings available in the coming year. Once the retained earnings have been exhausted, the firm can raise additional funds by selling new ordinary shares, netting $10 per share after underpricing and flotation costs.

Calculate the cost of each source of financing, as specified:

a. Long-term debt, first $550 000.

b. Long-term debt, greater than $550 000

c. Preference shares, all amounts

d. Ordinary share capital, first $1.75 million

e. Ordinary share capital, greater than $1.75 million.

f. Find the break points associated with each source of capital and use them to specify each of the ranges of total new financing over which the firm's WACC remains constant.

g. Calculate the WACC over each of the ranges of total new financing specified in f.

h. Using your findings in g along with the IOS, draw the firm's weighted marginal cost of capital (WMCC) and IOS on the same set of axes (total new financing or investment on the x-axis and WACC and IRR on the y-axis).

i. Which, if any, of the available investments would you recommend that the firm accept? Explain your answer.