Reference no: EM132053

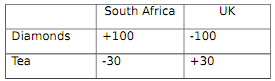

Question 1): Consider two Countries that share the same technology, South Africa and the UK, and two goods, Diamonds and Tea. There is a Free Trade Agreement in place between them. The Capital Labor ratio to produce Diamonds (K/LD) equals 3, while the Capital Labor ratio to produce Tea (K/LT) is 2. Trade between the two countries is described by the following table (Imports have negative sign, Exports have positive sign; the numbers reported are already converted in a common international currency):

Interpret this situation using the lens of the Heckscher-Ohlin Model:

a) Which country is Capital Abundant? Which country is Labor Abundant?

b) Suppose the endowment of Capital for South Africa gets bigger. At constant world prices, what do you expect will happen to South

Africa's production Mix?

c) "Labor unions are likely to oppose the free trade agreement in the UK": True or False? Briefly discuss why

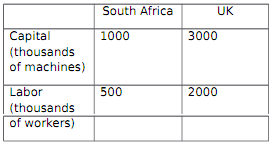

d) Suppose data is released on the endowment of Capital and Labor for South Africa and the UK, as the following Table describes:

Change ONE assumption in the Heckscher-Ohlin model and rationalize the observed pattern of trade between the two countries

Question 2): Consider the reading posted for week 4 on the class webpage ("China hits back at EU wine over solar panel duties".

a) Suppose China is relatively capital abundant and wine is produced with a labor intensive technology. What does the H-O model predict?

b) Consider we have Increasing Returns to Scale in the Production of Solar Panels. One possible interpretation for this "Trade War" is that both countries in the EU and China want to become leading exporters of Solar Panels. Comment briefly on this statement.

c) Consider we start from a situation in which the EU and China's K/L happen to be EXACTLY the same! In the initial situation there's no

trade between them. Suppose we have a demand shock in China and all of a sudden Chinese consumers want to consume more wine; demand for Solar Panels in China is unchanged. Also, demand in the EU is unchanged. What would the H-O model predict?

d) Suppose now the Ricardo's model of Trade. Suppose China is exporting Solar Panels and importing Wine and trade is balanced. What happens to trade if there's a positive demand shock for Wine in the EU?

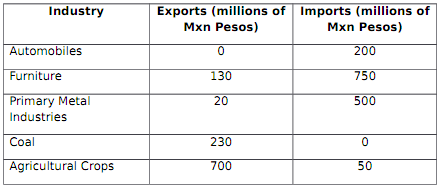

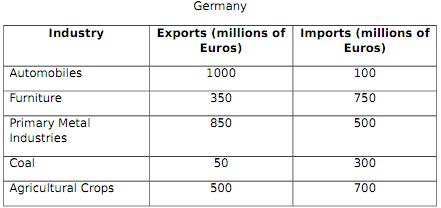

Question 3): Evaluate the value of the Intraindustry Trade Index for Mexico and Germany using data from the following table

Question 4): For this part of the Homework, you will have to elaborate data from the Canadian International Merchandise Trade Database

You are encouraged to use a spreadsheet for this part.

Select "Netherlands" as a Trading Partner. Use Annual Data, month of reference: July.

a) Retrieve Data for 2013. Calculate the Intraindustry Trade Index after merging Domestic Exports and Re-Exports in a unique category:

Exports. You should be summing over XXI categories of Merchandise Trade.

b) Retrieve Data for 1990. Calculate the Intrindustry Trade Index after merging Domestic Exports and Re-Exports in a unique category:

Exports. Is it bigger or smaller than in 2013? What does this seem to suggest about patterns of Trade between Canada and Netherlands over time? Comment

c) Retrieve Data for 2013. Select Section "XI - Textiles and Textiles Articles", Recalculate the Intraindustry Trade index just for this category and report your result. What value do you obtain if you consider only the aggregate values for this section? What is bigger?

d) Compare now Trade between the Canadian Province of British

Columbia and Washington State and between the Canadian

Province of Ontario and Michigan.

It seems that for category XIV, B.C. exports more than what imports from Washington State while the opposite happens for Ontario.

Can you suggest one or more possible explanations for this fact?