Reference no: EM131891607

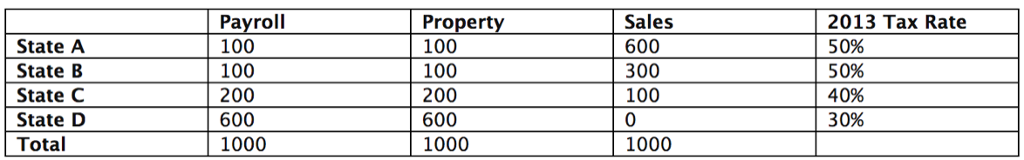

Question: You are the tax advisor to a company (the "Company") that had $1,000 in apportionable business income for tax year 2013. The Company did business in 4 states in 2013 and had nexus in each of the 4 states. The breakdown of its property, payroll and sales factors in each state is set forth below. Each State's tax rate is set forth in the last column.

State A uses a single-sales factor formula. State B uses the three-factor formula, but it triple-weights the sales factor. State C uses the three-factor formula, but it double-weights the sales factor. State D uses the traditional three-factor formula (property, payroll and sales) and weights each factor equally. Assume that no factors are thrown-out, even if zero.

a. Calculate the taxes owed by the Company in each state for the 2013 tax year and the total taxes owed by the Company for the year.

b. Would the total 2013 taxes owed by the Company be higher or lower if each of the States used the traditional three-factor formula (with each factor equally weighted) and why? (You are not required to calculate the exact taxes on this question, but you may).

c. If the Company were able to show using separate accounting that only $300 of its income for the tax year should be apportioned to State A (which would result in $150 taxes owed for 2013), would this prove that State A's apportionment calculation was unconstitutional when applied to the taxpayer? Is State A's use of a single-sales factor formula unconstitutional?

|

Why is the hierarchical structure limited in capability

: In the tale of two units, Unit B functioned much more smoothly that Unit A. Identify the macro- level coordination mechanisms being used in Unit B.

|

|

Expected after-tax cash flow from selling piece of equipment

: What is the expected after-tax cash flow from selling a piece of equipment if Litchfield Design purchases the equipment today for 120,000 dollars,

|

|

What is the project MIRR and NPV

: A project has an initial cost of $68,775, expected net cash inflows of $15,000 per year for 9 years, What is the project's MIRR?

|

|

Explain Kanban system with a supermarket concept

: Taichi Ohno, a former Toyota vice president, promoted the idea of JIT and developed Kanban to improve manufacturing efficiency.

|

|

Calculate the taxes owed by the company

: Calculate the taxes owed by the Company in each state for the 2013 tax year and the total taxes owed by the Company for the year.

|

|

What would after-tax cash flow be from equipment sale

: What would the after-tax cash flow be from the equipment sale if the equipment is sold in 9 years for 110,000 dollars and the tax rate is 10 percent?

|

|

Discuss the exponential smoothing method

: Now, forecast the demand for Weeks 2 through 6 using the exponential smoothing method with a = 0.8. How does it compare to that in part (c)?

|

|

Market required yield to maturity on comparable-risk bond

: How does the value change if the? market's required yield to maturity on a? comparable-risk bond? (i) increases to 13 percent or? (ii) decreases to 6 percent?

|

|

House for the full term and ignore taxes in your analysis

: Assume the homeowner will remain in the house for the full term and ignore taxes in your analysis.

|