Reference no: EM13197606

1. Brie?y describe each of the REIT stocks and equity stocks that you picked for your project.

2. Use a eight year holding period (2004 - 2013). Now calculate the average annual return for each stock, and for each REIT stock for the entire period. Use the formula:

3. Which is the riskiest security and which is the least risky based on the Standard Deviation? (Remember, the higher the standard devi-ation the riskier the stock will be). Compare the standard deviation of each security over the entire period.

4. Calculate all possible cross-correlations (REIT1 vs REIT2, Stock1 vs Stock2, REIT1 vs Stock1, REIT1 vs Stock2, REIT2 vs Stock1 and REIT2 vs Stock2).

5. How has the correlation among these securities changed over time? Plot each of the price series and comment.

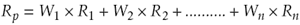

6. Build three separate portfolios and allocate weights as you wish for each portfolio. Portfolio 1 is the real estate only portfolio, Portfolio 2 is the equity only portfolio and Portfolio 3 is the combined real estate and equity portfolio. Calculate portfolio returns (based on average annual return that you calculated in question 2). Use the following formula :

Where Ws are the weights and Rs are the annual returns.

7. Compare the returns of the real estate only portfolio, the equity only portfolio and the combined portfolios (comprised of both real estate and equity). Please discuss the performance of the three portfolios in depth paying special attention to the concept of diversi?cation.

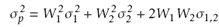

8. Calculate, the standard deviations of the portfolios over the entire period. Use the standard deviations that you calculated in question number 3. Remember, you need to use the following formula to calculate the standard deviation of portfolios:

Note that this formula is only applicable for a 2 asset case. You need to extend the formula such that it is applicable to a four assets case.

9. Use one of the investment performance measures that we have learned in class (such as Sharpe Ratio) and evaluate the performance of these port-folios on a risk-adjusted basis for the entire period. Discuss your results as it relates to portfolio diversi?cation bene?ts.