Reference no: EM131597

QUESTION 1:

(a) Mary is celebrating her 30th birthday; she has decided that as from her 31st birthday she must start to contribute to a pension plan, so as to secure her expenses once she retires at the age of 60 years old. By studying her family background, Mary estimates that she could live up to 85 years. Mary has estimated that once she retires in order to meet her expenses, she would need at least Rs42 000 each year. She also wants Rs30 000 to be left to cover her final expenses, including cremation.

After having contacted some insurance companies; the following two investment alternatives were offered to Mary.

(i) Pay a premium of Rs4000 each year, until her 60th birthday.

(ii) Pay a premium of Rs3000 each year, until her 40th birthday. Then pay a premium of Rs4500 from her 41st birthday, until her 60th birthday.

Assume that the long-term interest rate that will prevail for the two alternatives is equal to 8%.

Explain in details which one of the two alternatives given by insurance companies, you would advise Mary to undertake and which will enable her to cover all the future expenses that she has estimated.

(b) Company March has issued stocks in the market; the strategy of the company is to reinvest all its earnings over the next two years. At the end of year two it is forecasting earnings per share of Rs10 and a payout ratio of 0.4 for the next year.

It is being forecasted that as from the end of year three and over the next five years, the dividend growth rate will be constant at 10%. Then over the next three years there will be a constant gradual decrease in the growth rate and it will stabilize at 4% at that time; the constant dividend growth rate of 4% will prevail for an indefinite time period.

Today the stocks of Company March are selling at Rs100 in the market and Mr. May wants to assess if an investment in the stocks of the company would be a good investment. The required rate of return of Mr. May is equal to 8%.

Calculate the actual intrinsic value of the stock issued by Company March and advise if it is a good investment for Mr. May.

QUESTION 2:

(a) An investor wants to purchase a stock, after studying the market he has selected two stocks issued by companies Red and Blue and he has gathered the following information about the stocks: - Company Red is expected to pay a fixed amount of dividend equal to Rs10 each year over an indefinite time period.

- Company Blue paid a dividend of Rs5 in the past year and it is expected that its dividend will grow at a constant rate of 4% over an indefinite time period.

The required rate of return of the investor is equal to 10%.

(i) If the market prices of the stocks issued by companies Red and Blue are as follows: Rs110 and Rs80; explain if the investor should buy stocks from Company Red or Company Blue or should buy none of the stocks.

(ii) If the inflation rate is increased, could this have an impact on the decision taken by the investor in part (i) of this question. Explain.

(b) A bond has maturity 2 years, with coupon rate 5% and nominal value Rs1000. If Rs1018.8609 is invested in the bond (market price of bond), what is the YTM?

(c) At the 01/ 09/ 08 an investor is purchasing a bond from a seller; the last coupon on the bond was paid on the 01/ 05/ 08 and the maturity date is 01/ 05/ 12. The bond has a coupon rate of 10% and nominal value Rs1000. The yield to maturity is equal to 8%.

QUESTION 3:

Determine the dirty price paid by the buyer. (Assume 30 days per month)

(a) If the efficient market hypothesis holds, which of the following statements are true/false? Briefly justify each of your answers.

(i) it implies that future events can be forecast with perfect accuracy

(ii) it implies that prices reflect all available information

(iii) it implies that prices fluctuate in a random manner

(b) Briefly distinguish between the 3 different forms of ‘Market Efficiency'.

(c) Briefly explain a test which can be used to assess if a market is efficient in the weak form.

QUESTION 4:

(a) Describe the main characteristics possessed by debt securities that are issued by the two main issuers. Give any four examples of debt securities issued by these two issuers.

(b) A bond issued by a company has a nominal value of Rs100, with an annual coupon rate of 7.4% and maturity 3 years. Calculate the intrinsic value of the bond if annual required rate of return is equal to 7% and the coupon payments are made semi-annually.

If the market price of the bond is equal to Rs100, would you advise an investor to purchase the bond?

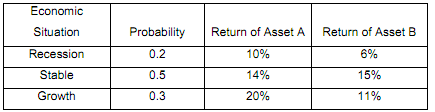

(c) The possible rates of return of two assets, A and B, under different economic conditions are given below:

An investor places 50% of his funds in Asset A and 50% in Asset B.

Required:

(i) Calculate the risk and expected return for each asset.

(ii) Calculate the risk and expected return of the investor's 2-assets portfolio.

(iii) What do you understand by total risk?