Reference no: EM132566039

The Hill Mfg Firm came up with the following activity-based OH rates for general overhead.

Question 1. Using the overhead or activity rates below (already calculated for you), apply the activity costs to the Y-30 product. (I've already correctly calculated the Activity-Based OH for the X-20 product.)

Machine setups - $130 per setup Soldering - $2.25 per joint

Quality control - $40 per inspection Shipments - $220 per shipment

Purchase orders - $75 per order Machine related - $8 per machine hour

|

|

Product X-20

|

|

Product Y-30

|

|

|

Expected Activity

|

Amount of OH

|

|

Expected Activity

|

Amount of OH

|

|

Machine setups

|

xx setups

|

$130,000

|

|

600 setups

|

|

|

Quality control

|

xx inspect

|

160,000

|

|

5,000 inspections

|

|

|

Purchase orders

|

xx orders

|

63,000

|

|

360 orders

|

|

|

Soldering

|

xx joints

|

135,000

|

|

140,000 joints

|

|

|

Shipments

|

xx shipments

|

88,000

|

|

200 shipments

|

|

|

Machine related

|

xx machhrs

|

240,000

|

|

40,000 mach hrs.

|

|

|

Total overhead costs

|

|

$816,000

|

|

|

|

Question 2. The Hill Mfg Firm expects to produce and sell 30,000 X-20 products and 5,000 Y-30 products. What total Overhead per unit should be charged to each of these 2 products?

Question 3. The firm believes that it cannot raise prices on either of these 2 products in the short-term, but will investigate whether specific cost initiatives should be undertaken.

A. Calculate the per unit cost per activity

B. Next, identify 2 activity costs (from above) that you would suggest that Hill Mfg investigate first.

C. Why did you pick these 2 costs? Discuss the reasoning behind your choices - do not simply say ‘the cost was high'. Think about what is causing the high cost.

Question 4. HoneyButter Company

The HoneyButter Company makes flavored butter in 1 pound containers. At the beginning ofMarch, the firm's Mixing Department already had 10,000 pounds of butter in production. During the month, the firm started 100,000 pounds, and completed 95,000 pounds and transferred them to the Packaging Department. All direct materials are added at the beginning of the production cycle and conversion costs are added uniformly throughout the production process. The Weighted Average method of process costing is used by HoneyButter. Beginning work in process was 25% complete as to conversion costs, while ending work in process was 20% complete as to conversion costs. Other information about costs to date follow:

Beginning inventory: Manufacturing costs added during the March accounting period

Direct materials costs $ 1,800 Direct materials costs $154,400

Conversion costs $ 7,200 Conversion costs $ 90,800

REQUIRED:

Complete and submit the following table including the T-Accounts. You can create your own ‘new' file or use this WORD document. Rather than ‘typing in the numbers', you may want to write them in and send a scanned pdf file. The Drop Box does not accept JPEG or pictures.

HoneyButter Company

|

Flow of production

|

Physical Units

|

Direct Materials

|

Conversion

|

|

WIP, beginning

|

|

|

|

|

Started during period

|

|

|

|

|

To account for

|

|

|

|

|

|

|

|

|

|

Units completed & Transferred

|

|

|

|

|

WIP, ending

|

|

|

|

|

Accounted for

|

|

|

|

|

Costs

|

Totals

|

Direct Materials

|

Conversion

|

|

WIP, beginning

|

|

|

|

|

Costs added during period

|

|

|

|

|

Total costs to account for

|

|

|

|

|

Divided by equivalent units

Equivalent unit costs

|

|

|

|

|

|

|

|

|

|

Assignment of costs

|

|

|

|

|

Completed units (completed and transferred)

|

|

|

|

|

WIP, ending

|

|

|

|

|

Costs accounted for

|

|

|

|

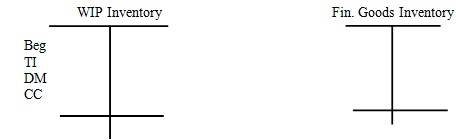

Complete the T-Accts below. Enter the Beginning and Current costs (you don't need to include the credits). Then post the entry (debit and credit) for the costs for Completed &Transferred. Balance the WIP Inventory account by entering the End WIP.

Question 5. Reutter, Inc.

Reutter, Inc. makes a single product and uses the FIFO method of process costing. The company's product goes through two processing departments - Etching and Wiring - which completes the process. This problem focuses on the Writing department which received the ‘etched' products and then completes them by adding appropriate writing. In Wiring, the direct materials are placed into production when the process is 35% complete. Conversion costs are incurred evenly throughout the process. The relevant information for April is below:

|

Beginning work in process inventory

|

10,000 items, 30% complete as to conversion

|

|

Units started in April

|

170,000 units

|

|

Ending work in process inventory

|

20,000 items, 40% complete as to conversion

|

|

|

|

|

|

Transferred-In Materials Conversion

|

|

Cost of beginning work in process

|

$ 7,000 $ 0 $ 4,900

|

|

Current costs in April

|

$187,000 $153,000 $ 244,200

|

REQUIRED:

Complete and submit the following table including the T-Accounts. You can create your own ‘new' file or use this WORD document. Rather than ‘typing in the numbers', you may want to write them in and send a scanned pdf file. The Drop Box does not accept JPEG or pictures.

Reutter, Inc.

|

Flow of production

|

Physical Units

|

Transferred-In

|

Direct Materials

|

Conversion

|

|

WIP, beginning

|

|

|

|

|

|

Transferred in

|

|

|

|

|

|

To account for

|

|

|

|

|

|

|

|

|

|

|

|

Units completed &Transf

|

|

|

|

|

|

WIP, ending

|

|

|

|

|

|

Accounted for

|

|

|

|

|

|

Costs

|

Totals

|

Transferred-In

|

Direct Materials

|

Conversion

|

|

WIP, beginning

|

|

|

|

|

|

Costs added during period

|

|

|

|

|

|

Total costs to account for

|

|

|

|

|

|

Divided by equivalent units

|

|

|

|

|

|

|

|

|

|

|

|

Assignment of costs

|

|

|

|

|

|

Completed units (completed and transferred)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

WIP, ending

|

|

|

|

|

|

Costs accounted for

|

|

|

|

|

|

|

|

|

|

|

Complete the T-Accts below. Enter the Beginning and Current costs (you don't need to include the credits). Then include the entry (debit and credit) for the costs for Completed &Transferred. Balance the WIP Inventory account by entering the End WIP.