Reference no: EM13854066

1) Comparative Analysis Case

The Coca-Cola Company and Pepsi Co.

Intructions:

Go to the book's companion's website and use information found there to answer the following questions related to The Coca-Cola Company and Pepsi Co.

a) How much working capital do each of these companies have at the end of 2011?

b) Compute each company's (a) current cash debt coverage, (b) cash debt coverage, (c) current ratio, (d) acid-test ratio, (e) accounts receivable turnover for 2011. Comment on each company's overall liquidity.

c) In Pepsi Co's financial statements, it reports in the long-term debt section "short-term borrowings, reclassified". How can short-term

borrowings be classified as long-term debt?

d) What type of loss or gain contingencies do these two companies have at the end of 2011?

2) Financial Statement Analysis Cases

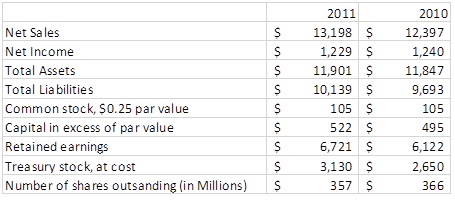

Case 1 Kellogg Company

Kellogg Company is the world's leading producer of ready-to-eat cereal products. In recent years, the company has taken numerous steps aimed at improving its profitability and earnings per share. Presented below are some basic facts for Kellogg.

Instructions:

a) What are some of the reasons that management purchases its own stock?

b) Explain how earnings per share might be affected by treasury stock transactions

c) Calculate the ratio of debt to assets for 2010 and 2011, and discuss the implications of change.

3) Accounting, Analysis, and Principles

On January 1, 2014, Agassi Corporation had the following stockholder's equity accounts.

Common stock ($10 par value, 60,000 shares issued and outstanding) ___ $600,000

Paid-in-capital in excess of par - common stock _____________________ $500,000

Retained earnings _____________________________________________ $620,000

During 2014, the following transactions occurred.

Jan 15 - Declared and paid a $1.05 cash dividend per share to stockholders.

Apr 15 - Declared and paid a 10% stock dividend. The market price of the stock was $14 per share.

May 15 - Reacquired 2,000 common shares at a market price of $15 per share

Nov 15 - Reissued 1,000 shares held in treasury at a price of $18 per share.

Dec 31 - Determined that net income for the year was $370,000.

Accounting: Journalize the above transactions. (Include entries to close net income to Retained earnings.) Determine the ending balances for Paid-in-capital, Retained earnings, and stockholders' equity.

Analysis: Calculate the payout ratio and return on common stock equity.

Principles: R. Federer is examining Agassi's financial statements and wonders whether the "gains" or "losses" on Agassi's treasury stock transactions should be included in income for the year. Briefly explain whether, and the conceptual reasons why, gains or losses on treasury stock transactions should be recorded in income.

|

Net of all expenses except capital costs

: AppsAlot is a small company that develops a variety of apps for smart phones. Management desires to raise $10 million in funds to initiate and continue various projects. With that funding, they project an earnings (net of all expenses except capital ..

|

|

Economic profit and compare to his accounting profit

: Your buddy Gabe owns a sports restaurant/bar in St. Louis. On a recent visit, Gabe shared the following information on his annual revenue and costs: Assume that Gabe has a standing offer of $70,000 to manage another bar in St. Louis. Calculate Gabe’s..

|

|

Fully explain why the marginal cost function

: An economy produces 2 goods soda a beer. Fully explain why the marginal cost function in the beer industry derives from the marginal benefits of the soda that is given up when beer is produced.

|

|

Explain how the price-specie-flow mechanism operates

: Explain how the price-specie-flow mechanism operates to maintain balanced trade between countries. What are the assumptions that are critical to the mechanism's successful operation?

|

|

Calculate the payout ratio and return on common stock equity

: Calculate the payout ratio and return on common stock equity.

|

|

The ethics of mandated naptime

: Sleep deprivation is a brutal truth of college life and negatively affects performance in the classroom of college students. Medical Journal A says that lack of sleep causes blah, blah, blah (citation). This epidemic has also plagued college campuse..

|

|

What would be the result of adding an ip address

: What would be the result of adding an IP address in front of the port number in the Listen directive and Navigate to the ServerRoot directive and record the path that is contained in quotes to the right of the directive.

|

|

Testimony of credible witnesses

: As it was discussed in the class materials, people usually learn about, discover, or prove any reality in the following 3 methods: 1. Using sensory perceptions, 2. logical inference, and 3. reliance on expert testimony of credible witnesses.

|

|

Prepare the journal entries necessary

: Prepare the journal entries necessary

|