Reference no: EM13321106

QUESTION 1

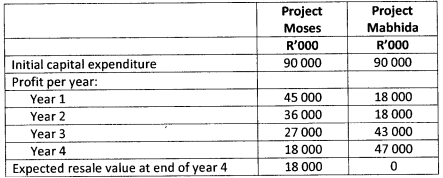

The following data relate to two investment projects, only one of which may be selected:

Required:

1.1 Calculate the payback period for Project Mabhida (year, month and days).

1.2 Calculate the accounting rate of return for each project.

1.3 Use the net present value (NPV) method to determine which project should be chosen.

1.4 Briefly discuss the merits of using the NPV method.

QUESTION 2

Company Anitha has a share capital of RS million, R1 ordinary shares (ungeared). Company Bianca has a share capital of RS million, R1 ordinary shares and R5 million 10% debentures (geared).

Scenario 1: High operating profits of R3 million. Scenario 2: Low operating profits of R600 000.

Required:

Calculate the effect that scenario 1 and 2 have on EPS.

QUESTION 3

Bigeyes Ltd needs to acquire advanced security monitoring equipment costing R500 000 to expand their facilities in order to be more competitive. The equipment can be purchased or leased. The after-tax cost of the debt is 7% and the company is in the 30% tax bracket.

The terms of the lease and purchase plans are as follows:

Lease

The leasing agreement would require annual end-of-year payments of R88 150 over the five years. The lessee will exercise its option to purchase the equipment for R35 600 at the end of the lease.

Purchase

The cost could be financed with a five year, 15% loan, requiring equal annual payments of R119 326. The company will pay R12 000 per year for a service contract that covers all costs. The straight-line method of depreciation is used. The company plans to keep the machine beyond its five year recovery period.

The interest payments for the respective five years are R60000; R51 100; R40 868;R29 090 and R15 500.

Required:

3.1 Determine the after-tax cash outflows and the net present value of the cash outflows under each alternative (round off to the nearest rand)

3.2 Which alternative would you recommend? Why?

3.3 Discuss the reasons in favour of leasing.

QUESTION 4

The directors of Bulkmart (Ltd) have appointed you as a merger and acquisition specialist. They are considering the acquisition of Welmart (Ltd). You are to advise them whether or not to proceed with the project.

The following information is available:

Bulkmart(Ltd) Welmart (Ltd)

Market price per share R20.00 R16.00

Earnings per share R6.00 R4.80

No. of shares issued 4 million 1 million

• Cash payment to Welmart Ltd = R24 million.

• Synergy benefits of R20 million will accrue through the acquisition.

Required:

Assume the acquisition is based on market values with a cash payment:

4.1 Calculate the combined value of the proposed acquisition

4.2 Calculate the net present value of the proposal

4.3 Calculate the acquisition premium

4.4 Calculate the post-acquisition market price of the share

4.5 Calculate the post-acquisition increase/decrease price of the share

4.6 Calculate the exchange ratio based on earnings per share

4.7 Calculate the total number of shares in the proposed acquisition

4.8 Calculate the post-acquisition earnings per share

4.9 Calculate the benefits, if any, to the two parties

4.10 Compare and contrast the reasons for the purchase of shares versus the purchases ofassets in a company.