Reference no: EM131337059

Cost of Capital

The Marietta Corporation, a large manufacturer of mufflers, tailpipes, and shock absorbers, is currently carrying out its financial planning for next year. In about two weeks, at the next meeting of the firm's board of directors, Frank Bosworth, vice president of finance, is scheduled to present his recommendations for next year's overall financial plan. He has asked Donna Botello, manager of financial planning, to gather the necessary information and perform the calculations for the financial plan.

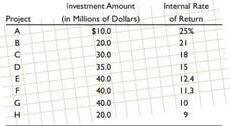

The company's divisional staffs, together with corporate finance department personnel, have analyzed several proposed capital expenditure projects. The following is a summary schedule of acceptable projects (defined by the company as projects having internal rates of return greater than 8 percent):

All projects are expected to have one year of negative cash flow followed by positive cash flows over the remaining years. In addition, next year's projects involve modifications and expansion of the company's existing facilities and products.

As a result, these projects are considered to have approximately the same degree of risk as the company's existing assets. Botello feels that this summary schedule and detailed supporting documents provide her with the necessary information concerning the possible capital expenditure projects for next year. She can now direct her attention to obtaining the data necessary to determine the cost of the capital required to finance next year's proposed projects. The company's investment bankers indicated to Bosworth in a recent meeting that they feel the company could issue up to $50 million of 9 percent first-mortgage bonds at par next year.

The investment bankers also feel that any additional debt would have to be subordinated debentures with a coupon of 10 percent, also to be sold at par. The investment bankers rendered this opinion after Bosworth gave an approximate estimate of the size of next year's capital budget, and after he estimated that approximately $100 million of retained earnings would be available next year. Both the company's financial managers and its investment bankers consider the present capital structure of the company, shown in the following table, to be optimal (assume that book and market values are equal):

|

Debt

|

$ 400,000,000

|

|

Stockholders' equity:

|

|

|

Common stock

|

150,000,000

|

|

retained Earnings

|

450,000,000

|

|

|

$ 1,000,000,000

|

Botello has assembled additional information, as follows:

¦ Marietta common stock is currently selling at $21 per share.

¦ The investment bankers have also indicated that an additional $75 million in new common stock could be issued to net the company $19 per share.

¦ The company's present annual dividend is $1.32 per share. However, Bosworth feels fairly certain that the board will increase it to $1.415 per share next year.

¦ The company's earnings and dividends have doubled over the past 10 years. Growth has been fairly steady, and this rate is expected to continue for the foreseeable future. The company's marginal tax rate is 40 percent.

Using the information provided, answer the following questions. (Note: Disregard depreciation in this case.)

1. Calculate the after-tax cost of each component source of capital.

2. Calculate the marginal cost of capital for the various intervals, or "packages," of capital the company can raise next year. Plot the marginal cost of capital curve.

3. Using the marginal cost of capital curve from question 2, and plotting the investment opportunity curve, determine the company's optimal capital budget for next year. 3

4. Should Project G be accepted or rejected? Why?

5. What factors do you feel might cause Bosworth to recommend a different capital budget than the one obtained in question 3?

6. Assume that a sudden rise in interest rates has caused the cost of various capital components to increase. The pretax cost of first-mortgage bonds has increased to 11 percent; the pretax cost of subordinated debentures has increased to 12.5 percent; the company's common stock price has declined to $18; and new stock could be sold to net Marietta $16 per share.

a. Recompute the after-tax cost of the individual component sources of capital.

b. Recompute the marginal cost of capital for the various intervals of capital Marietta can raise next year.

c. Determine the optimal capital budget for next year at the higher cost of capital.

d. How does the interest rate surge affect Marietta's optimal capital budget?

|

Capital gain of the tips in percentage terms

: TIPS Capital Return Consider a 2.75% TIPS with an issue CPI reference of 184.60. At the beginning of this year, the CPI was 191.70 and was at 201.60 at the end of the year. What was the capital gain of the TIPS in percentage terms? (Do not round t..

|

|

Explain the relationship between leadership and control

: Explain the relationship between leadership and control. Explain what is meant by the phrase "in the flow." Identify and explain two methods or ways to increase skill and competency.

|

|

The expected return on the market portfolio

: Acetate, Inc., has equity with a market value of $23.1 million and debt with a market value of $9.24 million. Treasury bills that mature in one year yield 6 percent per year, and the expected return on the market portfolio is 11 percent. The beta of ..

|

|

Developing a search marketing strategy

: What options do marketers have when it comes to developing a search marketing strategy?

|

|

Calculate the marginal cost of capital

: Calculate the marginal cost of capital for the various intervals, or "packages," of capital the company can raise next year. Plot the marginal cost of capital curve.

|

|

Under-valued or over-valued

: Under/Over Valued Stock A manager believes his firm will earn a 12.40 percent return next year. His firm has a beta of 1.46, the expected return on the market is 9.6 percent, and the risk-free rate is 4.6 percent. Compute the return the firm shoul..

|

|

Find the surface temperature of the tube

: For air at a temperature and cross flow velocity of T∞ = 25°C, V = 0.1 m/s, respectively, determine the surface temperature of the tube. The surroundings temperature is Tsur = 25°C.

|

|

Resolving ethical issues and dilemmas

: The mission and vision statements drive the outcomes of an NPO or NGO and generally involve social change or public service. For this reason, the daily operations of NPOs and NGOs aim at social goals rather than the accumulation of wealth. These o..

|

|

Describe one way that you could be proactive in searching

: Identify and describe one way that you could be proactive in searching for new opportunities and in taking risks. What future trends - demographics, technology, etc - are likely to influence you and your organization?

|