Reference no: EM131022614

Quiz 2-

1. Answer the following question based on the graph below which depicts the market for bicycles in Econoland, a small closed economy. D is the demand curve, S is the supply curve, P is the price per bicycle and Q is the quantity of bicycles.

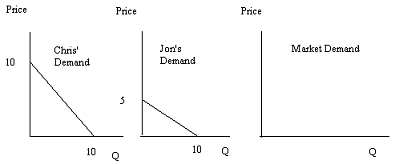

a. Suppose the government passes a price floor in the market for bicycles and this price floor is set at P1.

i. Given this price floor, consumer surplus = _____________________

ii. Given this price floor, producer surplus = _____________________

iii. Given this price floor, deadweight loss = _____________________

b. Suppose the world price of bicycles is P3 and Econoland simultaneously eliminates the price floor while opening up its bicycle market to trade.

i. Given this information, consumer surplus with trade = __________________________

ii. Relative to the closed economy (with no price floor) the open economy's area of consumer surplus (increases, decreases) by area __________________________

iii. When Econoland opens this market to trade, Econoland (exports, imports) an amount of bicycles equal to _______________________

2. Consider the market for pillows in Slumberland, a closed economy. The following equations represent the domestic demand in Slumberland for pillows and the domestic supply in Slumberland for pillows where P is the price per pillow and Q is the quantity of pillows.

Domestic Demand: P = 1000 - 4Q

Domestic Supply: P = 6Q

You are also told that the world price of pillows is $200.

a. Suppose Slumberland opens its pillow market to trade. Calculate the level of imports or exports in Slumberland when it opens this market to trade.

b. Suppose Slumberland after opening this market to trade imposes a tariff so that the price of pillows after imposition of this tariff is $300.

i. If Slumberland decided to replace this tariff with a quota, how big would the quota need to be in order for the two policies to have the same deadweight loss?

ii. Suppose Slumberland has imposed the tariff. Calculate the deadweight loss from this tariff. Show your work for full credit.

3. Suppose the hat market has two customers, Chris and Jon. The two graphs below provide their two demand curves for hats. In the third graph draw the market demand curve and indicate the coordinates (x, y) for the endpoints of any segments of this demand curve. Then write the equation(s) for this demand curve and indicate the range of prices for each segment of the demand curve. Use P to represent the price per hat and Q to represent the quantity of hats.

|

Increase in risk to equity holders when financial leverage

: The increase in risk to equity holders when financial leverage is introduced is evidenced by: A. higher EPS as EBIT increases. B. a higher variability of EPS with debt than all equity. C. increased use of homemade leverage. D. equivalence value betwe..

|

|

What is the unemployment rate in funland

: Given this information: What is the unemployment rate in Funland? Carry your answer to one place past the decimal. What is the frictional unemployment rate in Funland? Carry your answer to one place past the decimal

|

|

Statements is true of zero coupon bonds

: Which of the following statements is true of zero coupon bonds?

|

|

How many rights must you turn in to get a new share

: The Wordsmith Corporation has 10,000 shares outstanding at $30 each. They expect to raise $150,000 by a rights offering with a subscription price of $25. How many rights must you turn in to get a new share? A. 0.60 B. 1.20 C. 1.67 D. 2.00 E. Insuffic..

|

|

Calculate the level of imports or exports in slumberland

: Suppose Slumberland opens its pillow market to trade. Calculate the level of imports or exports in Slumberland when it opens this market to trade

|

|

About predicted weather patterns-severe storm safety tips

: The Foggy Futures Weather Network offers an annual almanac for sale each year with information about predicted weather patterns, severe storm safety tips, and a tracking chart. The finished product sells for $ 35 with a variable cost per unit of $21...

|

|

Calculate the market value of a firm with total assets

: Calculate the market value of a firm with total assets of $105 million and $50 million of 10% perpetual debt in the capital structure. The perpetual EBIT is expected to be $9 million and the marginal tax rate is 40%?

|

|

Venture capitalists will frequently

: Venture capitalists will frequently A. hold voting preferred stock which will allow them priorities over common stockholders in the event of bankruptcy or liquidation.

|

|

What is the present value of the tax shield to a firm

: What is the present value of the tax shield to a firm that has a capital structure consisting of $100million of perpetual debt and $180 million of equity, if then average interest rate on debt is 9%, the return on equity is 13%, and the marginal tax ..

|