Reference no: EM13837957

Q1 Which of the following is not an example of unsystematic risk?

- Factory destroted by fire.

- The chief executive officer resigns.

- Changes in the level of interest rates.

- A legal suit against a company for environmental pollution.

- The development of a new product line.

Q2 Given the information in the table below calculate the standard deviation of a portfolio combining Asset A and Asset B in the proportions of 40% and 60%, respectively. A correlation of .5 exists between A and B.

|

Asset

|

SD

|

Weight

|

|

A

|

.10

|

.4

|

|

B

|

.15

|

.6

|

Give your answer as a decimal accurate to three decimal places.

Q3 Given the following information calculate the standard deviation of returns of a portfolio that combines government bonds with the market portfolio.

Rm = .11

Rf = .05

Standard Deviation of market return = 0.14

Enter your answer as a decimal accurate to three decimal places.

Proportion invested in Rm = 0.6

Q5 Combining two securities whose returns are perfectly positively correlated (ie correlation coefficient is +1) results only in risk averaging and does not proved any risk reduction.

True

False

Q6 Systematic risk represents:

risk that is not diversifiable.

none of the options given.

unique risk

diversifiable risk.

risk that is diversifiable.

Q7 The covariance of a variable with itself is its standard deviation. Covariance (Ri,Ri) = Square Root of Variance (Ri)

True

False

Q8 A risk-neutral investor is an investor who neither likes or dislikes risk

True

False

Q9 Which of the following investments does a rational risk averse investor prefer? s = standard deviation.

Investment B: E(R) = 10%, s = 5%

Investment C: E(R) = 11%, s = 3%

None of the given options, as a rational investor would require more information from which to make a decision.

Investment A: E(R) = 10%, s = 3%

Q10 The Capital Market LIne (CML) can be written as

E(Rp) = Rf + [E(Rm)-Rf]*σp/σm

E(Rp) = Rf + [E(Rm)-Rf]*σm/σp

E(Rp) = Rf + [E(Rm)-Rf]*σp/σ2m

Rp = αp + β*Rm + εp

E(Rp) = Rf + [E(Rm)-Rf]*σpm/σ2m

Q11 Calculate the expected return from a portfolio consisting of three securities with the following expected returns and weights:

|

|

Expected Return

|

Weight

|

|

Security A

|

0.10

|

40%

|

|

Security B

|

0.12

|

40%

|

|

Security C

|

0.14

|

20%

|

0.114%

11.6%

11.4%

12%

36%

Q12 The benefit of diversification to an investor is:

the reduction of brokerage costs.

the reduction of systematic risk.

the reduction of research time.

the reduction of brokerage costs and risk.

the reduction of unsystematic risk.

Q13 Referring to the Capital Market Line (CML) which of the following strategies has the highest exprected return and the highest risk for the investor?

Invest all of her or his funds in Rm

Invest in a portfolio of 50% in Rf and 50% in Rm

Invest 75% in Rm and 25% in Rf

Borrow at the riskless rate and invest his or her funds, plus the borrowed money in Rf

Invest all his or her funds in the riskless asset

Borrow at the riskless rate and invest his or her funds, plus the borrowed money in Rm

Q14 Which distribution can be fully described by its expected value and standard deviation?

frequency distribution

Normal distribution.

Probability distribution.

discrete distribution

Both Normal distribution and Probability distribution.

None of the given options.

Q15 Which of the following statements are correct. There may be more than one correct.

Variances are not linearly additive.

An effecient portfolio has a correlation with the market equal to one.

The covariance of a variable with itself is its variance. Cov (Ra,Ra) = Var(Ra)

Correlation ranges from plus one to minus one.

The market portfolio is efficient.

Rf has a standard deviation of zero.

The covariance of a variable with a constant is zero. Cov(Ra.Rf) = 0

When combining Rf and Rm into a portfolio the proprotions must add up to one or a humdredpercent, but they do not both have to be positive.

Q16 Assume two securities A and B. The correlation coefficient between these two securities can be written as:

ρa,b = Cov(Ra,Rb) σa σb

ρa,b = Cov(Ra,Rb) /σb

ρa,b = Cov(Ra,Rb) /σa

ρa,b = Cov(Ra,Rb) /σa σb

ρa,b = Cov(Ra,Rb) /σ2a σ2b

Q17 Increasing the amount of wealth in Asset A whilst maintaining the entire wealth invested in a portfolio consisting of two assets only, A and B (assume that the expected return and standard deviation of both assets are A: 0.10 and 0.03, and B: 0.15 and 0.05, respectively):

may reduce the variance of the portfolio regardless of the correlation coefficient between Assets A and B.

will increase the expected return of the portfolio.

More information is needed before the impact on expected return can be determined.

will decrease the expected return of the portfolio, but the expected return will be closer to 15% than before.

will decrease the expected return of the portfolio, but the expected return will still be greater than if the portfolio consisted of Asset A only.

Q18 Examine the following probability distribution:

|

Return

|

Probability

|

|

0.04

|

0.1

|

|

0.06

|

0.2

|

|

0.08

|

0.4

|

|

0.1

|

0.2

|

|

0.12

|

0.1

|

The mean and standard deviation are:

0.08 and 0.0693, respectively.

0.06 and 0.022, respectively.

0.08 and .022, respectively.

0.06 and 0.0693, respectively.

0.07 and 0.022, respectively.

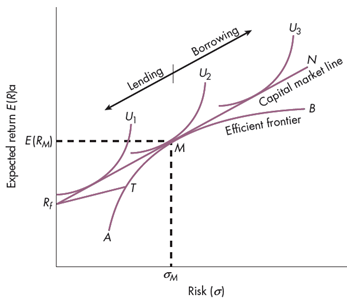

With respect to the graph above (PBEHP, 12 Ed, page 191).

Q19 Which of the following statements is incorrect?

The portfolios represented by the points on the line through Rf and M dominate the portfolios represented by the line Rf through T

The lowest risk portfolio is a portfolio of 100% in government bonds, at point Rf

For investors the levered (borrowing) portfolios from M up to N provide higher returns than the portfolios from Rf to M.

The lines U1, U2, and U3 represent the utility function of three different investors, U1 represents a risk averse investor, U2 represents a risk neutral investor and U3 is a risk seeker

To reach a point on the line Rf through to N, that is above M the weight or proportion of Rf must be negative

Q20 Which type of risk is unique to a firm and may be eliminated by diversification?

Total risk.

Macro risk.

Unsystematic risk.

Non-Diversifiable Risk

Systematic risk.

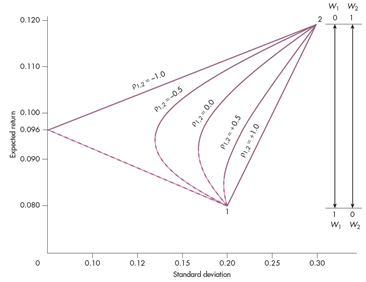

Q21 With respect to the graph provided above (PBEHP 12th Ed, page 184) which of the following statements is incorrect.

A risk-averse investor would prefer combinations on the hard red line represented by ρ1,2 = -1.0, as opposed to all of the other feasible combinations below this line

Risk-averse investors would never hold combinations of the two securities represented by by points on the on the dotted lines

When the correlation coefficient is -1, risk can be eliminated completely

A risk-averse investor does not like risk and so would prefer to invest in the portfolio represented by the point where the expected return is .096 and the standard deviation is zero, because this portfolio has zero risk

The degree of risk reduction increases as the correlation between returns on the two securities decreases coefficient

Q22 The capital market line [CML]:

describes the equilibrium risk-return relationship for risky portfolios.

does not have anything to do with efficient portfolios

describes the equilibrium risk-return relationship for all portfolios.

describes the equilibrium risk-return relationship for riskless portfolios.

describes the equilibrium risk-return relationship for efficient portfolios.