Reference no: EM13199227

Question

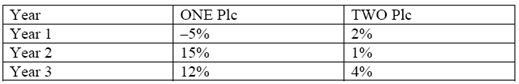

a) Over the past three years (Year 1 to Year 3) the stocks of two companies, ONE Plc and TWO Plc, generated annual returns to shareholders as follows:

i. For each of the three years (Year 1, Year 2, Year 3), calculate the annual return generated by a portfolio that is made up of the two stocks ONE and TWO with 80 percent of the portfolio invested in stock ONE and the rest in stock TWO.

ii. Based on the annual portfolio returns, calculate the expected portfolio return and the standard deviation of portfolio returns.

iii. Can the standard deviation of the portfolio returns be approximated as the weighted average of the individual stock returns? Explain why or why not.

b) Assuming the Capital Asset Pricing Model (CAPM) holds, calculate the expected returns and the risk premia of the following two portfolios.

1. Portfolio 1 has a beta of 1.5; the return on the market portfolio Rm is expected to be 8% and the riskfree rate Rf is 1%.

2. Portfolio 2: the estimated correlation coefficient between the returns on Portfolio 2 and the market portfolio returns is 0.1, the standard deviation of the market portfolio returns is 3%, and the standard deviation of the returns of Portfolio 2 is 8%; the values of Rm and Rf are as for Portfolio 1.

In each of parts (b1) - (b2), clearly show the derivation of your results.

(c) What is the security market line, and how has it been used in practice to quantify the equity cost of capital faced by a company?

|

How many yards is the side of the initial square

: A square's side is increased by 7 yards, which corresponds to an increase in the area by 217 square yards. How many yards is the side of the initial square?

|

|

Appendix g security assessments

: Choose two settings from Ch. 9 of the text and list each setting. Then, complete the following tables. List five threats appropriate to the environment from the setting you chose.

|

|

How many textbooks of each type were sold

: A textbook store sold a combined total of history and biology textbooks in a week. The number of biology textbooks sold was less than the number of history textbooks sold. How many textbooks of each type were sold?

|

|

State systematically slaughter millions of innocent jews

: David's history teacher asks him why so many German people complied with hitters orders to systematically slaughter millions of innocent Jews.

|

|

Calculate the expected portfolio return

: What is the security market line, and how has it been used in practice to quantify the equity cost of capital faced by a company - calculate the expected portfolio return and the standard deviation of portfolio returns.

|

|

Dual labor market

: Did Norwegian Americans participate in Dual labor market. Environmental justice issues, Affirmative action

|

|

Input data and output process

: Identify at least three processes (capabilities) that are needed in order to keep track of your collection. Identify the input data required for each of the processes.

|

|

State how was the communication effective

: that applies three of the communication theories you have studied so far to your personal and/or professional life. For each theory you discuss, provide three examples of the theory at work in your life:

|

|

How much revenue as a share of output did inflation

: The amount that the government raises from the inflation rate tax is ΔM. (ΔM = change in money stock or the printing of more money or the change in the amount of money today from yesterday). Write ΔM as a fraction of nominal GDP.

|