Reference no: EM131134654

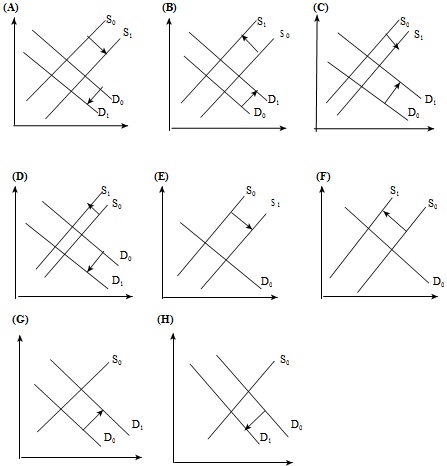

List of Graphs: Supply / Demand Curve Shifts in the Foreign Exchange (FX) Market

In each graph, the vertical axis represents the price of FX in US dollars and the horizontal axis represents the quantity of FX demanded / supplied. D0 and S0 refer to the initial supply and demand schedules while D1 and S1 refer to the initial supply and demand schedules after they shift. The arrows indicate the direction of the shift. Please choose the graph (A through H) which provides the best answer to the question.

Exercise # 1: Supply / Demand Schedules in the FX Market

The table below presents the supply and demand schedules for BP (from the US view point).

|

Price of BP

|

Schedule A

(# of BP supplied or demanded)

|

Schedule B

(# of BP supplied or demanded)

|

|

$1.40

|

1,000,000

|

10,000,000

|

|

$1.45

|

2,000,000

|

8,000,000

|

|

$1.50

|

3,000,000

|

6,000,000

|

|

$1.55

|

4,000,000

|

4,000,000

|

|

$1.60

|

5,000,000

|

2,000,000

|

|

$1.65

|

6,000,000

|

1,000,000

|

a) Identify the:

Supply schedule: Schedule A / Schedule B Demand schedule: Schedule A / Schedule B

b) What would be the clearing price for BP in the foreign exchange market? Why?

c) What would happen if both the US and the British governments fixed the price of BP at $1.45? Excess supply of BP / Excess demand for BP

d) Calculate the excess supply or demand for BP if both the US and the British governments fixed the price of BP at $1.60 .

Exercise # 2: The effects of economic factors in FX Market

Please used the list of graphs to answer questions 1, 3, and 5.

1. If the US inflation rate increased by 2% while the British inflation rate increased by 1%, identify which graph best describes what happens in the foreign exchange market for BP:

2. If the US inflation rate increased by 2%, while the British inflation rate increased by 3%, complete each one of the statements below:

a. The demand for BP in the FX market will: increase/decrease/not change

d. The supply of BP in the FX market will: increase/decrease/not change

c. The price of BP in the FX market will: increase/decrease/not change

3. If the US real interest rate increased by 2% while the British real interest rate did not change, identify which graph best describes what happens in the foreign exchange market for BP:

4. If the US real interest rate increased by 2% while the British real interest rate increased by 4%, complete each one of the statements below:

a. The demand for BP in the FX market will: increase/decrease/not change

d. The supply of BP in the FX market will: increase/decrease/not change

c. The price of BP in the FX market will: increase/decrease/not change

5. If the US economy moved into a recession, while the British economy remained the same, identify which graph best describes what happens in the foreign exchange market for BP:

Excercise # 3: Currency Price Expectations and Trading Strategy

Citibank can borrow/lend dollars at 6%. It can also borrow/lend euros (E) and pounds (BP) at 8%. It has access to $15,000,000, E20,00,000, or BP10,000,000 for currency speculation

How can Citibank make trading profits:

Scenario 1: If it expects BP to depreciate from $1.50 to $1.40 in 180 days. Scenario 2: If it expects E to appreciate from $0.75 to $0.80 in 90 days.

|

|

Scenario 1

|

Scenario 2

|

|

Which currency should you borrow in, and how much ?

|

|

|

|

Which currency should you invest in, and how much ?

|

|

|

|

What will be your profit in $ or FC

|

|

|

|

Which graph best describes what happens in the FX market

|

|

|

Currency Conversion Problem Set #1

Please use the following quotes, to answer the questions listed below:

|

Currency

|

Quotes

|

Direct or Indirect ?

|

|

Swiss francs

|

1 SF for $0.50

|

|

|

Mexican pesos

|

10 MP for 1 USD

|

|

|

British pounds

|

0.75 BP for 1 USD

|

|

1. $3,000,000 can be converted into British pounds

2. SF 1,500,000 can be converted into USD

3. MP 600,000 can be converted into Swiss francs

4a. How many SF does it take to buy 1 BP?

4b. How many BP does it take to buy 1 SF?

Currency Conversion Problem Set #2

|

|

1/1/X0

|

1/1/X1

|

|

BP quotes

|

$2.00 per BP

|

$2.18 per BP

|

|

SF quotes

|

SF 2.50 per USD

|

SF 2.00 per USD

|

|

JY quotes

|

JY100 per USD

|

JY 120 per USD

|

For the time period: 1/1/X0 - 1/1/X1, please calculate:

1. The percentage appreciation / depreciation of BP in terms of the USD

2. The percentage appreciation / depreciation of USD in terms of SF

3. The percentage appreciation / depreciation of JY from the US viewpoint

4. Suppose during this time period the indirect quote for MP decreased by 15%.

(i) By what % did the MP appreciate/depreciate from the US viewpoint?

(ii) By what % did the USD appreciate/depreciate from the Mexican viewpoint?

Currency Conversion Problem Set #3

|

Currency

|

Quotes on 1/1/X1

|

Quote on 1/1/X2

|

|

Canadian dollars

|

1 CD = $0.50

|

1 CD = $0.54

|

|

Swiss francs

|

SF 1.80 = 1 USD

|

SF 1.90 = 1 USD

|

|

Japanese yen

|

1 USD = JY 100

|

1 USD = JY 120

|

a. Based on the 1/1/X2 quote, convert 8,000,000 Canadian dollars into US dollars:

b. Based on the 1/1/X2 quotes, convert $25,000,000 into Swiss francs:

c. During the one-year period, what was the percentage appreciation / depreciation of the Japanese yen from the US point of view?

d. During the one-year period, what was the percentage appreciation / depreciation of the US dollar from the Swiss point of view?

Bid-Ask Spread Problem Set #1

The following table presents bid and ask quotes for BP from currency dealers in New York and London:

|

Currency Dealer in

|

New York

|

London

|

|

Bid Quote for BP

|

$ 1. 58

|

$ 1.65

|

|

Ask Quote for BP

|

$ 1. 68

|

$ 1.70

|

1. Assume that you dealt with the New York currency dealer only. You converted $100,000 into pounds, and immediately afterwards sold the pounds for dollars. Estimate the dollar amount you lost in this round trip transaction.

2. Assume that you dealt with the London currency dealer only. What is the percentage bid-ask spread for this dealer?

3. Which dealer (s) would you buy from, and sell to ?

Attachment:- Assignment.rar