Reference no: EM131247427

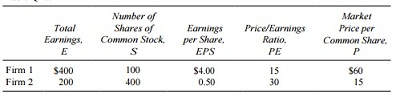

Firm 1 and firm 2 are contemplating a merger in which firm 1 will acquire firm 2. The information in Table Q20.1 has been developed on the two firms. In the questions and answers related to this case, let subscripts 1 and 2 refer to the individual firms. Let ER, stand for the

exchange ratio from the standpoint of firm 1 and ER2 stand for the exchange ratio from the standpoint of firm 2. AER is the actual exchange ratio. PE12 will be the price/earnings ratio for the merged firm, after the merger. a) The managements of the two firms are negotiating the terms of the merger, specifically the number of shares of firm 1 that will be exchanged for one share of common stock of firm 2. Three alternative criteria are under consideration:

i) The effect on each firm's earnings per share after the merger.

ii) The expected market value of the merged firm's common stock per one original share immediately after the merger. ]

iii) The expected market value of the holdings per one original share after synergistic effects have been developed, e.g., three years after the merger.

Of the three criteria, which would it be most rational for the management and shareholders of the firms to emphasize?

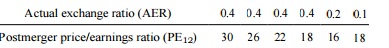

b) Using the estimates of the following range of postmerger PE12 values, determine the ER1 that will equate P1 to P12:

Range of possible PE12 values: 12, 15, 20, 25, 30. Make a graph on which ER1 is plotted against PE12 and label the curve ER1.

c) Calculate the ER2 that will equate P2 to P12 for the PE12 estimates given in part (b). Plot the curve ER2 on the graph begun in part (b).

d) At what PE12 do the two curves intersect? What is the significance of this point of intersection?

e) For the following combinations, calculate and graph the premium or loss to each firm: