Reference no: EM13205444

1 Missing Trading Ltd, purchased a business delivery vehicle on the 1 of January 2009 for R120 000. Calculate the amount of depreciation that would be recorded as the period expense for the third year of having the vehicle (i.e. 31st December 2011) if the reducing balance method is used on vehicles at 15% pa. Also clearly state what the carrying value would be on the delivery vehicle at the 31st December 2011.

2 Taking into account the same delivery vehicle as in 1.1 above, calculate the depreciation per period if the straight line method is applied.

3 Other than FIFO, state two (2) possible methods that could be considered when calculating the value of stock.

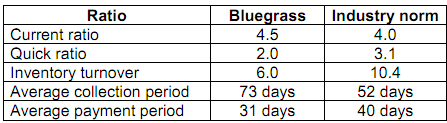

4 The new owners of Bluegrass Natural Foods have hired you to help them diagnose and cure problems that the company has had in maintaining adequate liquidity. As a first step, you perform a liquidity analysis. You then do an analysis of the company's short-term activity ratios. Your calculations and appropriate industry norms are listed.

a. What recommendations relative to the amount and the handling of inventory could you make to the new owners?

b. What recommendations relative to the amount and the handling of trade receivables could you make to the new owners?

c. What recommendations relative to the amount and the handling of trade and other payables could you make to the new owners?

d. What results, overall, would you hope your recommendations would achieve? Why might your recommendations not be effective?