Reference no: EM131317978

Warford Corporation was formed five years ago through a public subscription of common stock. Lucinda Street, who owns 15% of the common stock, was one of the organizers of Warford and is its current president. The company has been successful but currently is experiencing a shortage of funds. On June 10, Street approached Bell National Bank, asking for a 24-month extension on two $30,000 notes, which are due on June 30, 2011 and September 30, 2011.

Another note of $7,000 is due on December 31, 2011, but Street expects no difficulty in paying this note on its due date. Street explained that Warford's cash flow problems are due primarily to the company's desire to finance a $300,000 plant expansion over the next two fiscal years through internally generated funds.

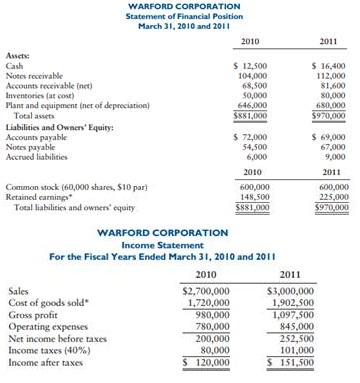

The commercial loan officer of Bell National Bank requested financial reports for the last two fiscal years. These reports follow:

Required

a. Calculate the following items for Warford Corporation:

1. Current ratio for fiscal years 2010 and 2011

2. Acid-test (quick) ratio for fiscal years 2010 and 2011

3. Inventory turnover for fiscal year 2011

4. Return on assets for fiscal years 2010 and 2011

5. Percentage change in sales, cost of goods sold, gross profit, and net income after taxes from fiscal year 2010 to 2011

b. Identify and explain what other financial reports and/or financial analyses might be helpful to the commercial loan officer of Bell National Bank in evaluating Street's request for a time extension on Warford's notes.

c. Assume that the percentage changes experienced in fiscal year 2011, as compared with fiscal year 2010, for sales, cost of goods sold, gross profit, and net income after taxes, will be repeated in each of the next two years. Is Warford's desire to finance the plant expansion from internally generated funds realistic? Explain.

d. Should Bell National Bank grant the extension on Warford's notes, considering Street's statement about financing the plant expansion through internally generated funds? Explain.

|

Discuss about the liability and quality

: As a healthcare administrator, you have been tasked with researching your hospital's compliance in the proper reporting of both medical and non-medical errors made by the staff. Compare the relationship of hospital's corporate liability with that ..

|

|

How would a company measure improvements

: Identify stakeholders and plan how manufacturing or service processes use value stream mapping. What is the benefit and why do companies do it? How would a company measure improvements?

|

|

Capital market line and the security market line

: What is the differences between the relationship described by the capital market line (CML) and the security market line (SML)? Consider a particular portfolio P with total risk σ p. When will the SML and CML equations give the same Erp?

|

|

What clarification do you need regarding the posting

: What clarification do you need regarding the posting? What were the most compelling topics learned in this course? How did participating in discussions help your understanding of the subject matter? Is anything still unclear that could be clarified..

|

|

Calculate the current ratio for fiscal years 2010 and 2011

: Identify and explain what other financial reports and/or financial analyses might be helpful to the commercial loan officer of Bell National Bank in evaluating Street's request for a time extension on Warford's notes.

|

|

Suppose that securities are priced according to the capm

: Suppose that securities are priced according to the CAPM. You have forecast the correlation coefficient between the rate of return on the High Value Mutual Fund (HVMF) and the market portfolio (M) at 0.8. How would you combine the HVMF and a risk fre..

|

|

What is the beta on the portfolio

: 40% of a portfolio is invested in Apple stock which has an expected return of 25% and a beta of 1.4. The remaining 60% of the portfolio is invested in Microsoft stock which has an expected return of 9% and a beta of 0.8. What is the beta on the ..

|

|

Are these funds as well-diversified as possible

: Consider two mutual funds, A and B. The beta for fund A is .60, and the standard deviation of the rate of return = .20. The beta for fund B. is 1.30 and its standard deviation of the rate of return = .325. The standard deviation of the market portfol..

|

|

Which best shows a company responding to identity pressures

: Which of the following best shows a company responding to identity pressures? Which of the following best defines the "congruence" model of diagnosing change?

|