Reference no: EM13205862

Gearing

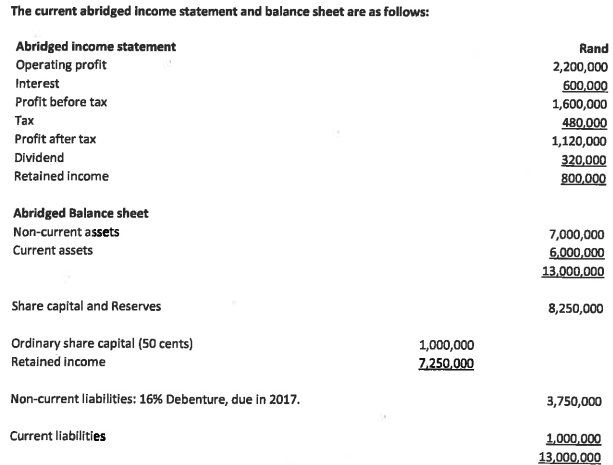

Tobi Industries wishes to undertake a project that will cost R2 500 000. The project has already been evaluated and has a positive net present value.

The decision now facing management is how to finance the project. Three alternative financial 'packages' are under consideration:

• issue 1 250 000 new ordinary shares at 200 cents each; or

• Issue R2 500 000 Debenture, due In 2020, at a fixed rate of interest of 7%; or

• issue 1 000 000, 15%, R2.50 preference shares.

The project is expected to generate an extra R500 000 of earnings (before Interest and tax) each year. The company pays tax at 30% and follows a policy of paying a constant ordinary dividend per share.

Required:

1. Calculate the current earnings per share (EPS).

2. Calculate the current gearing (non-current debt/equity, using book value).

3. Calculate the revised EPS and gearing using ordinary share financing.

4. Calculate the revised EPS and gearing using debenture financing.

5. Calculate the revised EPS and gearing using preference share financing.

6. Prepare a brief report, with supporting evidence, recommending which of these three financing sources the company should use.

|

What fiscal and monetary policies would be appropriate

: What is the current "macroeconomic situation" in the U.S.(e.g. is the economy currently concerned about unemployment, inflation, recession, etc) What fiscal and monetary policies would be appropriate at this time

|

|

Explain solution that contains acetic acid

: already have a solution that contains 10 mmol of acetic acid. how many millimoles of acetate will you need to add to this solution? the pKa of acetic acid is 4.74

|

|

State active ingredient in a full bottle of gaviscon tablets

: Each tablet contains 80. mg of the active ingredient and comes in bottles of one hundred. How many mL of a 0.100 M solution of HCl are required to dissolve ther active ingredient in a full bottle of Gaviscon tablets?

|

|

State what is the ph of the sample solution

: dissolved in 200 mL of solution. What is the pH of the solution? pKa1 = 6.37 and pKa2 = 10.25.

|

|

Calculate the current earnings per share

: Calculate the current earnings per share (EPS) and calculate the current gearing (non-current debt/equity, using book value).

|

|

Explain a standard oxalic acid solution

: A standard oxalic acid solution is 0.065 M. It was prepared by dissolving H2C2O4*2H2O in distilled water.

|

|

What is the elasticity of the demand for cookbooks

: Suppose that you expect to sell about 22,000 cookbooks per month online, and assume that your overhead, technology, and equipment costs are fixed. What are your total costs What are your marginal costs

|

|

Depict the structure of the product that is formed koh

: Draw the structure of the product that is formed when but-1-yne is treated with the following reagents:1) disiamylborane; 2) H2O2, KOH; 3) LiAlH4. Disiamylborane = [(i-Pr)(CH3)CH]2BH, a hindered derivative of BH3.

|

|

How to compare two view of current technological development

: Both Landes Winner and Bill Joy explore the issue of technology and control. How would you compare their two views of current technological development Focus the comparison on a specific technology, such as genetically modified organisms.

|