Reference no: EM13971625

Part 1: Forwards and Interest Rate Swaps Suppose that you are given the following term structure of zero coupon yields (spot rates).

Maturity r

0.5 0.02

1 0.025

1.5 0.03

2 0.04

Semi-annually compounded interest rates

1. From the given spot rates, calculate the forward rates, f(0, 0.5, 1), f(0, 1, 1.5), and f(0,1.5, 2).

2. Suppose that f(0, 1, 1.5) quoted by a FRA dealer is 4.5%. (This should be almost 0.5 percentage points higher than what you found above.) Using f(0, 1, 1.5) and the given zero coupon yields, construct an arbitrage trading strategy to take advantage of this mispricing.

3. What is the fair fixed rate in a 2-year interest rate swap in which fixed and floating payments are exchanged every six months? Note that this is a little different from the lecture slides where payments were quarterly and the reference rate was the three-month spot rate.

4. Suppose that half a year passes. The term structure of zero coupon yields is now

Maturity r

0.5 0.01

1 0.015

1.5 0.02

Semi-annually compounded interest rates

If you entered into a fixed-for-floating contract previously (with a notional of $100), what is the value of your position now?

Part 2: Treasury Bond Futures

It is July 30, 2015. The cheapest-to-deliver bond in a September 2015 Treasury bond futures contract is a 13% coupon bond with maturity at August 4, 2035. Delivery is expected to be made on September 30, 2015. Coupon payments on the bond are made on February 4 and August 4 each year. The term structure is flat, and the rate of interest with semiannual compounding is 12% per annum.

1. Calculate the current (full) price of the cheapest-to-deliver bond.

2. Calculate the conversion factor for the bond.

3. Calculate the quoted futures price for the futures contract.

Part 3: Fixed Income Options

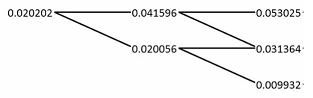

Suppose that you are given the following interest rate tree with semi-annually compounded interest rates.

Suppose that you are also told that σ = 0.015 and ? = 0.5.

1. Using the tree above, calculate the price of a 1.5-year cap with a strike of 3% and a notional of $100.

2. Calculate the price of a 1.5-year bond with a coupon rate of 3% (coupons paid semi-annually) and a face value of $100.

3. What is the price of a 1.5-year floor with a strike of 3% and a notional of $100?

Part 4: Callable Bonds

Now, let’s consider the pricing of callable bonds. We will compare this with non-callable bonds.

1. Using the tree from Part 2, calculate the value of a 1.5-year bond with a coupon rate of 3% (coupons paid semi-annually) that is callable at $100 at each coupon date (starting at t = 0.5) just after the coupon is paid. Recall that a callable bond price is equal to an equivalent non-callable bond price minus the value of the call.

2. Add 0.001 to all of the interest rates in the tree from Part 2. Calculate the price of the callable bond in (1) using this tree.

3. Subtract 0.001 from all of the interest rates in the tree from Part 2. Calculate the price of the callable bond in (1) using this tree.

4. Using the callable bond prices in (1), (2), and (3), calculate the modified duration of the callable bond using

B(y + ?y) − B(y − ?y) 1 2 × ?y × B(y)

5. Calculate the modified duration of the non-callable version of the 1.5-year bond. You should already have the prices you need for this in (1), (2), and (3).