Reference no: EM13831738 , Length:

QUESTION 1:

REQUIRED

1. Go on-line to https://www.reuters.com/finance/stocks/ and type in "DMP.AX" into the Search Stocks field and click on the magnifying glass button.

What is the beta for DMP?

You must also look up the value of beta for CWN.AX, WTF.AX, JET.AX and FLT.AX

2. Rank each of these five shares in the order from least risky to most risky. Explain in terms, as simple as possible, what the beta value reflects or represents.

3. Why do you think that Dominos Pizza has the lowest beta value of these five companies? Explain fully.

4. Go to the Australian Stock Exchange website https:///www.asx.com.au.

Type DMP into the top right hand search box

Then click on the first heading:

1. DOMINO'S PIZZA ENTERPRISES LIMITED (DMP) - ASX Listed Company Information Fact Sheet

Then click on "Charting" near the top of the left hand menu column.

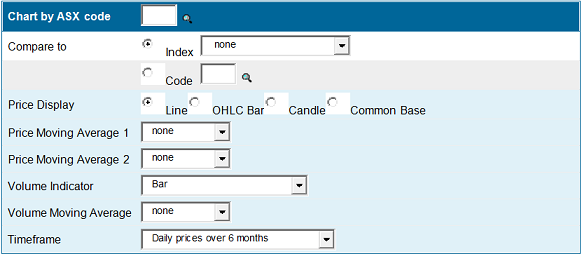

The blue box (reproduced below) will appear

Enter DMP in the top blue box "Chart by ASX Code"

Click on the ‘Index' drop box and select All Ordinaries Index

Click on the ‘Timeframe' drop box and select ‘Monthly prices for the past 5 years',

Click on ‘Create chart'

Copy and print the resultant chart.

Repeat this process to create a chart for CWN Crown Casinos.

Describe how these graphs demonstrate that the beta for Dominos Pizza is much lower than the beta for Crown Casinos.

5. If the risk free rate is 4% and the market Risk Premium is 6.5%, use the Capital Asset Pricing Model to calculate the required rate of return for each of these five shares.

6. A "personal question" - if you had $20,000 to invest for the next 4 years, and you were to choose just one company, which of these companies' shares would you invest in? Fully explain why. (There is no right answer for this question. Rather it will provide an insight as to how risk averse you are.) 3 marks

7. You have been made aware of the benefits of diversification. If you decided to invest $4,000 in each of the 5 companies' shares, calculate the beta for your portfolio of shares, and the required rate of return that you should earn overall.

8. Consider now that you would rather invest in and run your own business rather than just being a "passive shareholder". You have always dreamed of running your own pizza restaurant. You are confronted with two strategic options: to either open your own new restaurant (e.g. Papa Costa's Pizza) or to buy into a franchise such as DMP Dominos Pizza.

Fully describe 5 relative advantages / disadvantages of becoming a DMP franchisee.

9. In consultation with a business advisor you approach the owner of a reasonably popular Pizza restaurant in your neighbourhood which is currently for sale. The owner wishes to sell the business and property for $1 million.

Before you go ahead and "follow your dream" you begin to consider how you will raise the $1 million to purchase this business.

Your personal savings are only $200,000. You reckon that the most that you are willing / able to borrow from a bank is $300,000. How do you propose to raise the remaining $500,000 required to finance the purchase of your new business?

The first question that you need to answer is which business structure you will adopt;

• Sole proprietor

• Partnership

• Private company

• Public company

Write a succinct list of the pros and cons of each of the above alternatives given your specific finance needs.

10. Therefore, which of the above alternative business structures will you adopt. Explain fully.

11. Assuming that you decide to set up a private company and issue shares to friends, family and acquaintances, what would you tell / promise them in order to induce them to invest?

12. After examining his records of sales over the last few years, you prepare a budget estimate of the next 4 years, which is how long you intend to operate the restaurant before selling it.

You also determine or estimate that:

• the maximum capacity, given the current equipment etc,, is 1,500 pizzas per week.

• Sales next year would average about 70% of maximum capacity, and would then grow by 5% of capacity per annum for the subsequent 3 years (that is, 75%, 80%, 85%)

• The business could be sold in 4 years time for $1,250,000.

• You are willing to assume that pizza sell prices will remain constant @ $15 per pizza in year 1, but will then increase by $X per pizza for each of the following three years.

• and variable costs to produce would remain constant @ $7 per pizza throughout year 1, but will then increase by X cents per pizza for each of the following three years

• fixed costs per annum of operations will be $270,000 in year 1, but will increase as a rate of X% per annum over each of the following three years.

• Each group must inform the lecturer of their UNIQUE values of X for the above three variables: increase price (2.4), increase variable costs (1.8), and rate of % increase in fixed costs (2.2). (Hong Kong, Japan)

The projected income statement for the first year of operations is given below.

You are required to copy this "table" onto an Excel spreadsheet, and to prepare projected income statement for the following 3 years.

13. In part 4 above, you used the CAPM to calculate the required rate of return for Dominos Pizza. You wish to use this as a benchmark in order to calculate the rate of return which you should promise your shareholders. However, because you are only a small and new venture (and precisely because you are NOT the well known Dominos Pizza), your business advisor recommends that you add a further 5% to the Dominos Pizza rate to compensate for the further risk that is attached to investing in small businesses.

Therefore what rate of return should you be offering your shareholders?

14. Therefore, assuming that your 1 million is financed with 30% debt capital and 70% equity capital, and assuming the cost of equity you have calculated above and a cost of debt is 8% per annum, estimate the after-tax Weighted Average Cost of Capital for your business.

15. Calculate the Net Present Value for your business investment, using the Free Cash Flows provided and calculated in part 11) above, and the Weighted Average Cost of Capital calculated in part 13) above as the discount rate. (Don't forget the proposed estimated salvage value at the end of year 4.)

Show all workings

Would you recommend investing in this business or not? Explain.

QUESTION 2

Answer each of the following questions using the data on the attached sheet labelled ‘F.8 Share Price Indices'

1. Even a quick glance at the F.8 Share Price Indices will reveal that the Japanese Stock Market has the unique distinction of having been the only one to have "gone backwards" since 1990. Write a 600 word report on what were the major causes of this poor performance.

2. Many companies choose to be listed on a number of global stock markets. Write a 600 word report explaining why they choose to do this. Be sure to explain the costs and the benefits of this practice.

3. Assume that on 31 December 2008 your group had $3 million to invest equally across any 3 Stock Markets listed. (i.e. $1m in each of 3 markets).

i) Calculate which of the possible ‘portfolios' would have given you the maximum possible capital gain by the end of 2011.

ii) Calculate the overall value of your portfolio of shares.

iii) Calculate the annual compound rate of growth in the value of your overall portfolio over the three year period end of 2008 to 2011. (Show all workings)

4. Repeat all of part 3 above but his time in order to derive the lowest possible rate of capital growth for a portfolio evenly spread across three stock markets as at 2008.

5. If you had ‘perfect foreknowledge' as at the end of 2011, in which 3 stock markets would you have re-invested until the end May 2015?

6. Using the total value in your answer to part 3 ii) above, again spread evenly across the 3 stock markets that you selected in part 5) above, calculate the value of your overall portfolio as at the end of May 2015.

7. Your group must select which 2 stock markets in each of which they will invest $1 million as at the end of May 2012.

So that no two assignment groups have the same answers, you must notify the lecturer of which 2 stock markets in which you will invest.

Using the 36 monthly values from May 2012 - May 2015

a) Calculate the average monthly rate of return for each of your chosen stock markets (hint: be sure to calculate the relative rates of return)

b) Calculate the standard deviation of returns for each of your chosen stock markets over this period.

c) Comment on the relationships / results between parts a) and b) above. Is it consistent with the theory?

d) Calculate the Average Quarterly Rate of Return and the average standard deviation for your overall portfolio.

e) Comment on the relationships / results between parts d) and a) and b) above. Is it consistent with the theory?

8. Using the United States S&P Index as the surrogate for the GLOBAL MARKET, calculate the beta co-efficient for each of your chosen stock-markets.

9. Using the United States S&P Index as the surrogate for the GLOBAL MARKET, calculate the beta co-efficient for your overall portfolio.

(Show all workings)

10. Write a report which explains the strategies which investors must consider when making their investment choices. (400 words)

11. Write a report which outlines three limitations or ‘qualifications' that you would give to the report that you wrote in part 10 above.