Reference no: EM13194901

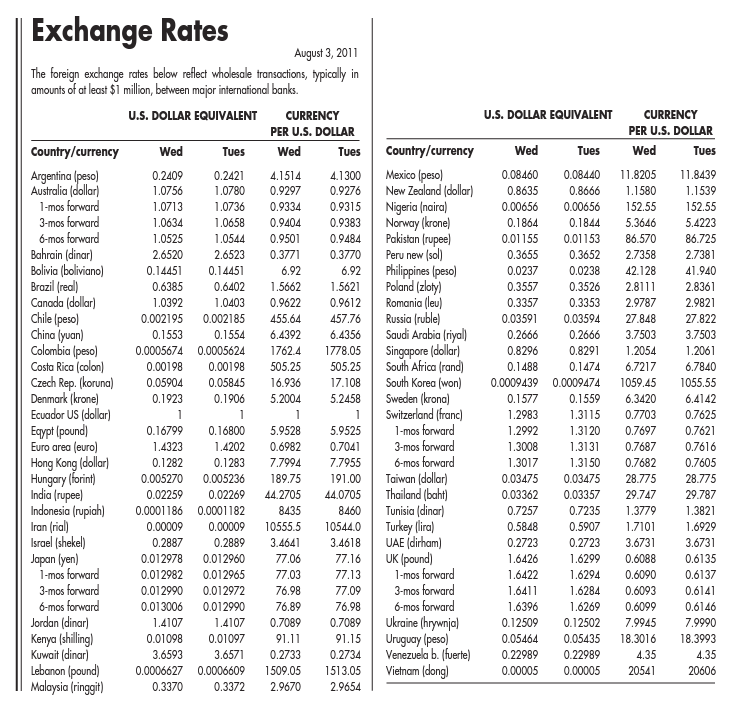

1. Calculate the annualized forward premium or discount on six-month forward yen.

2. If you are planning to go to Japan this summer, should you buy your yen today? Why or why not?

3. According to the covered-interest arbitrage theory, is the United States or Japan expected to have higher interest rates?

4. According to the covered-interest arbitrage theory, what is the expected difference between interest rates in the United States and Japan?

5. According to the international Fisher effect, is expected inflation higher in Japan or the United States?

B. Consider Belgian Lace Products (BLP), a hypothetical table linens manufacturer. BLP consists of a parent corporation, a wholly owned manufacturing subsidiary in Belgium, and four wholly owned distribution subsidiaries in Belgium, the United Kingdom, Japan, and the United States. Its manufacturing subsidiary buys inputs from various suppliers, manufactures highquality lace napkins and tablecloths, and sells the output to the four BLP-owned distribution subsidiaries. The four distribution subsidiaries in turn sell the products to retail customers in the subsidiaries' marketing areas. The distribution subsidiaries buy certain inputs, such as labor, warehouse space, electricity, and computers, from outside suppliers as well. The following summarizes typical monthly transactions for each of the BLP operating units (note that the symbol for the euro is € ):

Manufacturing Subsidiary

Sales to Belgian distribution subsidiary: € 15,000 Sales to British distribution subsidiary: €12,500 Sales to Japanese distribution subsidiary: € 17,500 Sales to U.S. distribution subsidiary: €11,250 Costs of inputs purchased from Belgian suppliers: €7,500 Costs of inputs purchased from British suppliers: £25,000 Costs of inputs purchased from Japanese suppliers: ¥3,000,000 Costs of inputs purchased from U.S. suppliers: $5,000

Belgian Distribution Subsidiary

Sales to retail customers: €50,000 Payments to BLP manufacturing subsidiary: €15,000 Payments to external suppliers: €750 and £10,000

British Distribution

Subsidiary Sales to retail customers: £75,000 Payments to BLP manufacturing subsidiary: €12,500 Payments to external suppliers: £5,000, €1,000, and $9,000

Japanese Distribution Subsidiary

Sales to retail customers: ¥5,000,000 Payments to BLP manufacturing subsidiary: €17,500 Payments to external suppliers: ¥3,000,000 and $8,000

U.S. Distribution Subsidiary

Sales to retail customers: $40,000 Payments to BLP manufacturing subsidiary: €11,250 Payments to external suppliers: $10,000 and ¥300,000

Exchange Rates

€1.33=€1

€1=$1.00

€1= €1 ¥120

Use the above information to answer the following questions:

1. Calculate the profitability of each of BLP's five subsidiaries. (Because BLP is Belgian, perform the calculations in terms of euros, which Belgium began using as its national currency in 2002.) Are any of the subsidiaries unprofitable? On the basis of the information provided, would you recommend shutting down an unprofitable subsidiary? Why or why not?

2. Suppose it costs each subsidiary 1 percent of the transaction amount each time it converts its home currency into another currency to pay its suppliers. Develop a strategy by which BLP as a corporation can reduce its total currency conversion costs. Suppose your strategy costs BLP 400 euros per month to implement. Should the firm still adopt your approach?

3. If the United Kingdom decided to join the EU's single currency bloc and use the euro, what effect would this have on BLP? What effect would it have on the benefits and costs of the strategy you developed to reduce BLP's currency conversion costs?