Reference no: EM131672695

Question: Multinational transfer pricing, goal congruence. Suppose that the U.S. division could sell as many chainsaws as it makes at $225 per unit in the U.S. market, net of all marketing and distribution costs.

1. From the viewpoint of the Burton Company as a whole, would after-tax operating income be maximized if it sold the 200,000 chainsaws in the United States or in France? Show your computations.

2. Suppose division managers act autonomously to maximize their division's after-tax operating income. Will the transfer price calculated in requirement 2 in Exercise result in the U.S. division manager taking the actions determined to be optimal in requirement 1 of this exercise? Explain.

3. What is the minimum transfer price that the U.S. division manager would agree to? Does this transfer price result in the Burton Company as a whole paying more import duty and taxes than the answer to requirement 2 in Exercise? If so, by how much?

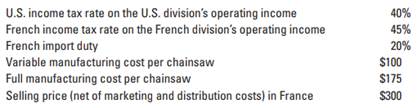

Exercise: Multinational transfer pricing, global tax minimization. The Burton Company manufactures chainsaws at its plant in Sandusky, Ohio. The company has marketing divisions throughout the world. A Burton marketing division in Lille, France, imports 200,000 chainsaws annually from the United States. The following information is available:

Suppose the United States and French tax authorities only allow transfer prices that are between the full manufacturing cost per unit of $175 and a market price of $250, based on comparable imports into France. The French import duty is charged on the price at which the product is transferred into France. Any import duty paid to the French authorities is a deductible expense for calculating French income taxes.

1. Calculate the after-tax operating income earned by the United States and French divisions from transferring 200,000 chainsaws

(a) at full manufacturing cost per unit and

(b) at market price of comparable imports. (Income taxes are not included in the computation of the cost-based transfer prices.)

2. Which transfer price should the Burton Company select to minimize the total of company import duties and income taxes? Remember that the transfer price must be between the full manufacturing cost per unit of $175 and the market price of $250 of comparable imports into France. Explain your reasoning.