Reference no: EM13850106

Question 1 Name two advantages and two disadvantages of using the corporation form of business.

Question 2 What is the difference between Common Stock and Preferred Stock? What are some of the advantages of owning Preferred Stock instead of Common Stock?

Question 3 Explain the difference between the declaration date, record date, and payment date in reference to dividends.

Question 4 On January 1, 20X5, Juan Silvia borrowed $500,000 to purchase a new office building. The loan is to be repaid in 2 equal annual payments, beginning December 31, 20X5. The annual interest rate on the loan is 9%.

Prepare the appropriate journal entries to record the loan and subsequent payments at the end of 20X5 and 20X6.

Use the following information to answer Question 5 - Question 8

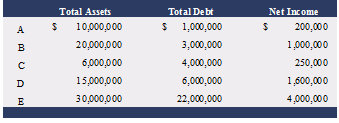

Jacob Joseph has identified five different companies in which he is interested in investing, based upon their products and prospects. However, Jacob is concerned about a general economic downturn and desires to invest in companies with the lowest debt exposure. Following is a list of the data for the five potential investments. Jacob has compiled the data and has ranked the companies based upon total debt. He has requested your help in evaluating the risk profiles for each company.

To complete your evaluation, you need to know that each company faces an income tax rate that is equivalent to 30% of income before taxes (which also means that net income is 70% of income before taxes). In addition, assume that each company incurs an average interest cost that is 8% of total debt.

Question 5 Calculate the debt to total asset ratio, and reorder the list from least risky to most risky, based upon that ratio.

Question 6 Calculate the debt to equity ratio, and reorder the list from least risky to most risky, based upon that ratio.

Question 7 Calculate the times interest earned ratio, and reorder the list from least risky to most risky, based upon that ratio.

Question 8 Do the ratios suggest that risk is a function of total debt, or other factors? Do all the ratios produce the same signals?

Question 9 What is the difference between the direct method and indirect method of completing the statement of cash flows? Which method is utilized by most companies?

Use the following information for Question 10 - Question 12

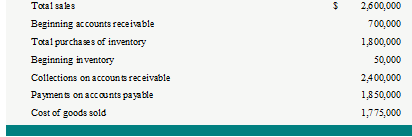

Stanley Corporation has no material problem with uncollectible accounts or obsolete inventory. All sales and purchases are on account. The company provided the following information for the year ending 20X7:

Question 10 Calculate the accounts receivable turnover ratio.

Question 11 Calculate the inventory turnover ratio.

Question 12 If Stanley's competitors have a receivables turnover ratio of "6" and an inventory turnover ratio of "4," would you initially conclude that Stanley is better or worse than its competitors in managing receivables and inventory? Why?

|

Should speculators use currency futures or options

: 1) Should Speculators Use Currency Futures or Options? 2) Please find out which currencies CITIBANK has to deal with. List the countries and currencies.

|

|

Required to create a small web site

: You are required to create a small web site. You have to choose the project idea and work in it as individual or with a group of maximum two students.

|

|

Benefits gained from the learning curve

: Burklin, Inc., has earnings of $18.6 million and is projected to grow at a constant rate of 4 percent forever because of the benefits gained from the learning curve. Currently, all earnings are paid out as dividends. Estimate the value of the stock.

|

|

A company''s defined benefit pension plan

: A company's defined benefit pension plan utilizes a funding formula that considers years of service and average compensation to determine the pension benefit payable to the plan participants. If Kim is a participant in this defined benefit pension pl..

|

|

Calculate the accounts receivable turnover ratio.

: Calculate the accounts receivable turnover ratio.

|

|

Calculate descriptive statistics fromthe data and display

: Calculate the descriptive statistics fromthe data and display in a table. Be sure to comment on the central tendency,variabilityand shape for housing price and two additional variables - Draw a graph that displays the relative share of bedrooms in ..

|

|

Write an essay on teen employment in cambodia

: Write an essay on Teen employment in Cambodia

|

|

Attempt to change ibm culture

: 1- Who is Grstner and what role did he play in IBM's transformation? 2- How did he attempt to change IBM's culture? 3- What role did institutional values have

|

|

What is the price per share of rite bite stock

: Rite Bite Enterprises sells toothpicks. Gross revenues last year were $8.0 million, and total costs were $3.9 million. Rite Bite has 1.2 million shares of common stock outstanding. Gross revenues and costs are expected to grow at 4 percent per year. ..

|